Technology Category

- Application Infrastructure & Middleware - Data Exchange & Integration

- Infrastructure as a Service (IaaS) - Cloud Databases

Applicable Industries

- Finance & Insurance

- Life Sciences

Applicable Functions

- Product Research & Development

Use Cases

- Inventory Management

- Leasing Finance Automation

Services

- System Integration

- Training

About The Customer

Aurec is a recruitment company that specializes in technology, banking, finance, and life sciences. Founded in Sydney in 2002 by Craig Bowater and Saul Kwintner, Aurec has experienced significant growth over the years, expanding its operations to Singapore, Canberra, Hong Kong, and Melbourne. The company works with many of the largest blue-chip clients in the Asia-Pacific region. Aurec's success is attributed to its investment in people, training, and state-of-the-art technology. The company's mantra of flexibility, innovation, and focus has been instrumental in its explosive success.

The Challenge

Aurec, a recruitment company specializing in technology, banking, finance, and life sciences, was grappling with the limitations of its legacy system. The system was server-based and slow, posing a significant hurdle to the company's growth and future-proofing plans. Aurec recognized the need to transition to the cloud to stay competitive and agile in the rapidly evolving recruitment industry. However, finding a provider that could offer a comprehensive, flexible, and forward-thinking solution proved to be a challenge. The company needed a system that could support its international operations, facilitate global expansion, and provide cutting-edge technology to its recruitment consultants. Moreover, the system had to be cloud-based to reduce overheads associated with internal servers and other hardware.

The Solution

Aurec decided to move its operations to the cloud and chose Bullhorn as its software provider. Bullhorn offered a complete, flexible, and cloud-based solution that met all of Aurec's needs. The company leveraged the Bullhorn Marketplace to invest in best-of-breed software that addressed specific business issues. This included LinkedIn Integration for social media, Daxtra for CV searching, Ebsta for collaboration, and InsightSquared for reporting and analytics. The new system was not only capable of supporting Aurec's international operations and global expansion plans but also provided the company's recruitment consultants with the best available technology. The transition to the cloud-based system significantly reduced Aurec's overheads on internal servers and other hardware, making the company more agile and competitive.

Operational Impact

Quantitative Benefit

Case Study missing?

Start adding your own!

Register with your work email and create a new case study profile for your business.

Related Case Studies.

Case Study

Real-time In-vehicle Monitoring

The telematic solution provides this vital premium-adjusting information. The solution also helps detect and deter vehicle or trailer theft – as soon as a theft occurs, monitoring personnel can alert the appropriate authorities, providing an exact location.“With more and more insurance companies and major fleet operators interested in monitoring driver behaviour on the grounds of road safety, efficient logistics and costs, the market for this type of device and associated e-business services is growing rapidly within Italy and the rest of Europe,” says Franco.“The insurance companies are especially interested in the pay-per-use and pay-as-you-drive applications while other organisations employ the technology for road user charging.”“One million vehicles in Italy currently carry such devices and forecasts indicate that the European market will increase tenfold by 2014.However, for our technology to work effectively, we needed a highly reliable wireless data network to carry the information between the vehicles and monitoring stations.”

Case Study

Safety First with Folksam

The competitiveness of the car insurance market is driving UBI growth as a means for insurance companies to differentiate their customer propositions as well as improving operational efficiency. An insurance model - usage-based insurance ("UBI") - offers possibilities for insurers to do more efficient market segmentation and accurate risk assessment and pricing. Insurers require an IoT solution for the purpose of data collection and performance analysis

Case Study

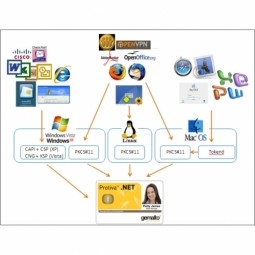

Corporate Identity Solution Adds Convenience to Beckman Coulter

Beckman Coulter wanted to implement a single factor solution for physical and remote logical access to corporate network. Bechman Coulter's users were carrying smart card badges for doors, but also needed a one-time password token to access to our corporate network when they were not in the office. They wanted to simplify the process.

Case Study

Smooth Transition to Energy Savings

The building was equipped with four end-of-life Trane water cooled chillers, located in the basement. Johnson Controls installed four York water cooled centrifugal chillers with unit mounted variable speed drives and a total installed cooling capacity of 6,8 MW. Each chiller has a capacity of 1,6 MW (variable to 1.9MW depending upon condenser water temperatures). Johnson Controls needed to design the equipment in such way that it would fit the dimensional constraints of the existing plant area and plant access route but also the specific performance requirements of the client. Morgan Stanley required the chiller plant to match the building load profile, turn down to match the low load requirement when needed and provide an improvement in the Energy Efficiency Ratio across the entire operating range. Other requirements were a reduction in the chiller noise level to improve the working environment in the plant room and a wide operating envelope coupled with intelligent controls to allow possible variation in both flow rate and temperature. The latter was needed to leverage increased capacity from a reduced number of machines during the different installation phases and allow future enhancement to a variable primary flow system.

Case Study

Automated Pallet Labeling Solution for SPR Packaging

SPR Packaging, an American supplier of packaging solutions, was in search of an automated pallet labeling solution that could meet their immediate and future needs. They aimed to equip their lines with automatic printer applicators, but also required a solution that could interface with their accounting software. The challenge was to find a system that could read a 2D code on pallets at the stretch wrapper, track the pallet, and flag any pallets with unread barcodes for inspection. The pallets could be single or double stacked, and the system needed to be able to differentiate between the two. SPR Packaging sought a system integrator with extensive experience in advanced printing and tracking solutions to provide a complete traceability system.

Case Study

Transforming insurance pricing while improving driver safety

The Internet of Things (IoT) is revolutionizing the car insurance industry on a scale not seen since the introduction of the car itself. For decades, premiums have been calculated using proxy-based risk assessment models and historical data. Today, a growing number of innovative companies such as Quebec-based Industrielle Alliance are moving to usage-based insurance (UBI) models, driven by the advancement of telematics technologies and smart tracking devices.