We collaborate with private equity firms throughout the entire investment lifecycle, ensuring that your investment thesis and approach are aligned. From refining your deal generation and sector screening process to maximizing post-acquisition value, we help guide every step. After acquisition, we focus on delivering rapid returns through strategic planning, onboarding experienced management teams, and leading targeted initiatives to unlock value.

Portfolio and Performance Management: Market volatility and regulatory changes in the region can impact revenues, assets, and profitability. Drawing on extensive experience from our portfolio companies and principal investments, we offer comprehensive support, from planning to implementation, to improve your bottom line and develop effective risk management strategies.

Asia M&A Strategies: Rising trade tensions are introducing new complexities into executive decision-making as uncertainties continue to shape the business environment. A thorough assessment of the challenges and opportunities in the Asian market is critical to understanding the M&A landscape. We provide deep insights to help mitigate the risks and capitalize on the potential of investing in the region.

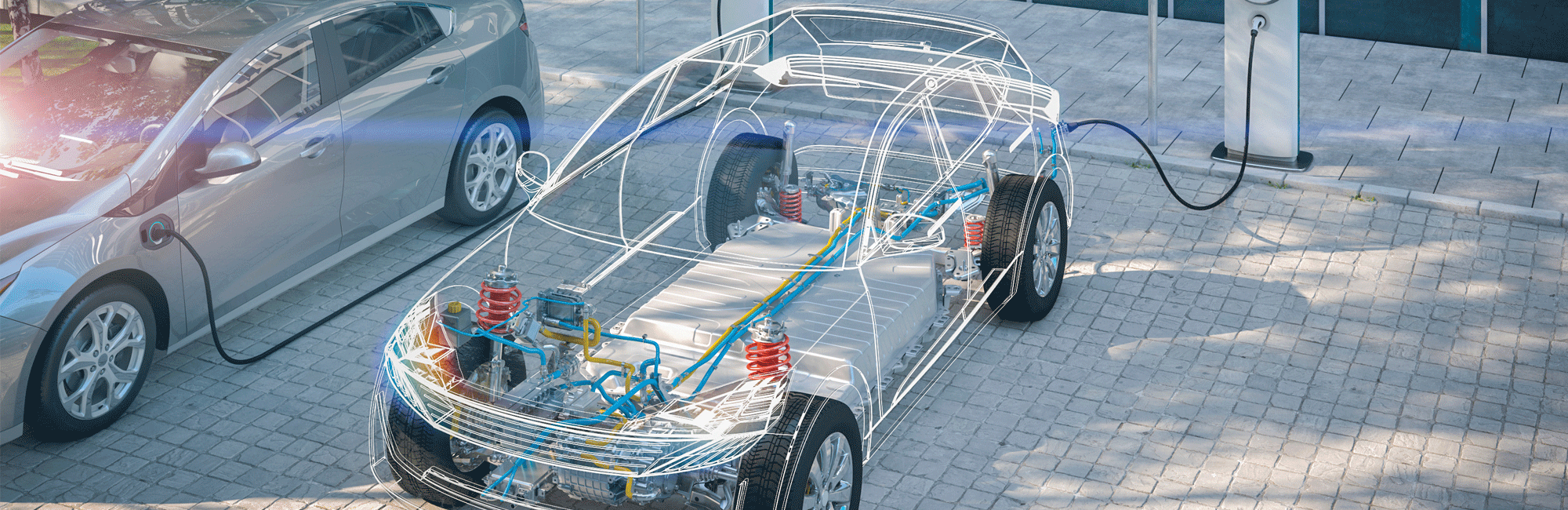

Tech in Asia: The region is a thriving hub for technology innovation, driven by a growing middle class, high digital adoption rates, and rapidly expanding economies. Tech unicorns are disrupting traditional industries, challenging incumbents for market share by capturing a large share of tech-savvy buyers.

Exit Support: Executing a successful exit is becoming more challenging, as private equity firms need to ensure long-term value creation. We provide critical support to help clients position their businesses for a successful exit, maximizing the value that has been built over time and ensuring a smooth transition.