Customer Company Size

Large Corporate

Region

- Europe

- America

- Asia

Country

- United Kingdom

- Hong Kong

- United States

Product

- CarbonChain

- CTRM (Commodity Trading and Risk Management) platform

Tech Stack

- Machine Learning

Implementation Scale

- Enterprise-wide Deployment

Impact Metrics

- Environmental Impact Reduction

- Customer Satisfaction

- Digital Expertise

Technology Category

- Analytics & Modeling - Machine Learning

- Functional Applications - Remote Monitoring & Control Systems

Applicable Industries

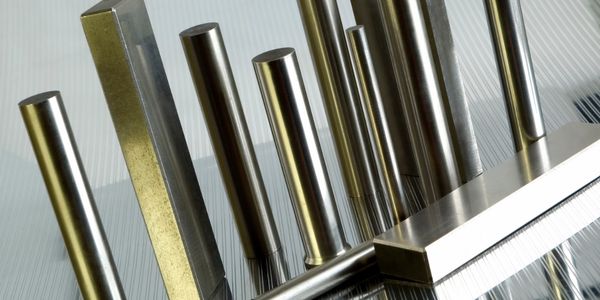

- Metals

- Mining

Applicable Functions

- Business Operation

Use Cases

- Supply Chain Visibility

Services

- Data Science Services

- System Integration

About The Customer

Concord Resources Limited is a prominent commodity merchant specializing in non-ferrous metals and associated raw materials. Established in 2015, Concord has rapidly grown to become one of the leading global independent traders in the metals and minerals sector. The company is headquartered in London, with representative offices in New York, Connecticut, and Hong Kong. Concord's focus on non-ferrous metals positions it at the forefront of the commodities market, where it engages in extensive trading activities. With a commitment to sustainability and innovation, Concord is dedicated to understanding and managing its carbon footprint, particularly its Scope 3 emissions, to align with the global transition towards a net-zero economy. The company's strategic approach to carbon accounting and its collaboration with CarbonChain demonstrate its leadership in the sector, as it seeks to set new standards for transparency and accountability in commodity trading.

The Challenge

In 2019, Concord faced the challenge of calculating Scope 3 emissions for its 10,000 annual trades. As a leading commodity merchant in the non-ferrous metals sector, Concord recognized the importance of understanding its carbon footprint to future-proof its business and manage carbon risk. The company aimed to take a market-leading approach in carbon accounting for commodity trading, which required accurate, verifiable, and comprehensive emissions calculations. Concord needed to benchmark its performance, break down emissions sources, and compare trades, suppliers, and assets to gain actionable insights for its carbon strategy. However, the task was daunting due to the sheer volume of manual data collection and analysis required, coupled with the notorious shortage of reliable emissions data for the extraction, production, and transport of commodities. Concord needed a cost-effective solution that could address these specific challenges, leading them to partner with CarbonChain.

The Solution

To address the challenge of calculating Scope 3 emissions, Concord partnered with CarbonChain, a company specializing in carbon accounting solutions. CarbonChain provided a comprehensive solution by extracting and organizing data from Concord's Commodity Trading and Risk Management (CTRM) platform. The process involved identifying gaps in the data, such as missing asset-level information, which is crucial for accurate emissions calculations. CarbonChain's technology, powered by machine learning, filled these gaps and modeled the 10,000 trades, tracking the commodities' movements from source to production to transportation. This approach enabled Concord to obtain a complete carbon footprint for its entire trade portfolio, with asset-level breakdowns. CarbonChain's software allowed for quick calculations, providing comprehensive emissions reports within 10 minutes. The solution offered Concord the ability to benchmark its carbon performance, rate trades, suppliers, and activities, and gain actionable insights for its carbon strategy. By embedding automated Scope 3 carbon accounting into its workflow, Concord is better prepared for changing regulations and stakeholder demands, and can proactively share its emissions data with stakeholders to support data-led decision-making.

Operational Impact

Quantitative Benefit

Case Study missing?

Start adding your own!

Register with your work email and create a new case study profile for your business.

Related Case Studies.

Case Study

Goldcorp: Internet of Things Enables the Mine of the Future

Goldcorp is committed to responsible mining practices and maintaining maximum safety for its workers. At the same time, the firm is constantly exploring ways to improve the efficiency of its operations, extend the life of its assets, and control costs. Goldcorp needed technology that can maximize production efficiency by tracking all mining operations, keep employees safe with remote operations and monitoring of hazardous work areas and control production costs through better asset and site management.

Case Study

KSP Steel Decentralized Control Room

While on-site in Pavlodar, Kazakhstan, the DAQRI team of Business Development and Solutions Architecture personnel worked closely with KSP Steel’s production leadership to understand the steel production process, operational challenges, and worker pain points.

Case Study

Bluescope Steel on Path to Digitally Transform Operations and IT

Increasing competition and fluctuations in the construction market prompted BlueScope Steel to look toward digital transformation of its four businesses, including modern core applications and IT infrastructure. BlueScope needed to modernize its infrastructure and adopt new technologies to improve operations and supply chain efficiency while maintaining and updating an aging application portfolio.

Case Study

RobotStudio Case Study: Benteler Automobiltechnik

Benteler has a small pipe business area for which they produce fuel lines and coolant lines made of aluminum for Porsche and other car manufacturers. One of the problems in production was that when Benteler added new products, production had too much downtime.

Case Study

Continuous Casting Machines in a Steel Factory

With a very broad range of applications, steel is an important material and has been developed into the most extensive alloy in the engineering world. Since delivering high quality is absolutely crucial for steel plants, ensuring maximum productivity and the best quality production are the keys to competitiveness in the steel industry. Additionally, working conditions in steel factories are not suitable for workers to stay in for long periods of time, so manufactures usually adopt various machines to complete the steel production processes. However, the precision of these machines is often overestimated and the lack of flexibility also makes supervisors unable to adjust operating procedures. A renowned steel factory in Asia planned to improve its Distributed Control System (DCS) of furnaces as well as addressing the problem of insufficient accuracy. However, most well-known international equipment suppliers can not provide a satisfactory solution and local maintenance because the project needed new technologies to more accurately control equipment operations. By implementing Advantech’s automated monitoring and control solution, steel factories can not only improve the manufacturing processes but can also allow users to add additional functions to the existing system so as to make sure the operation runs at high efficiency.

Case Study

Automated Predicitive Analytics For Steel/Metals Industry

Asset to be monitored: Wire Compactor that produces Steel RebarCustomer Faced The Following Challenges:Dependent upon machine uptime.Pressure cylinders within the compactor fail to control compression and speed causing problems in binding the coil.Equipment failure occurs in the final stage of production causing the entire line to stop, can you say bottleneck?Critical asset unequipped with sensors to produce data.