AGP China Technology Report - Security & Surveillance Robots

Table of Contents

Page Section

03 Technology Overview

07 Historical Development Timeline

10 Product Differentiation

14 China Technology Ecosystem

17 Sino-Foreign Collaboration

20 Common Applications In China

24 Government Policy Support

27 Impact On Market Incumbents

29 Final Conclusion

30 Appendices

1.1 Global Snapshot

Definition and Classification

Security and surveillance robots are autonomous or semi-autonomous machines designed to monitor, detect, and respond to security threats across various environments. These robots can be categorized into:

- Unmanned Ground Vehicles (UGVs): Robots operating on land, often used for patrolling and perimeter security.

- Unmanned Aerial Vehicles (UAVs): Drones utilized for aerial surveillance and rapid response.

- Unmanned Marine Vehicles (UMVs): Robots deployed in aquatic environments for monitoring and security purposes.

Key Technologies

The efficacy of security and surveillance robots hinges on several core technologies:

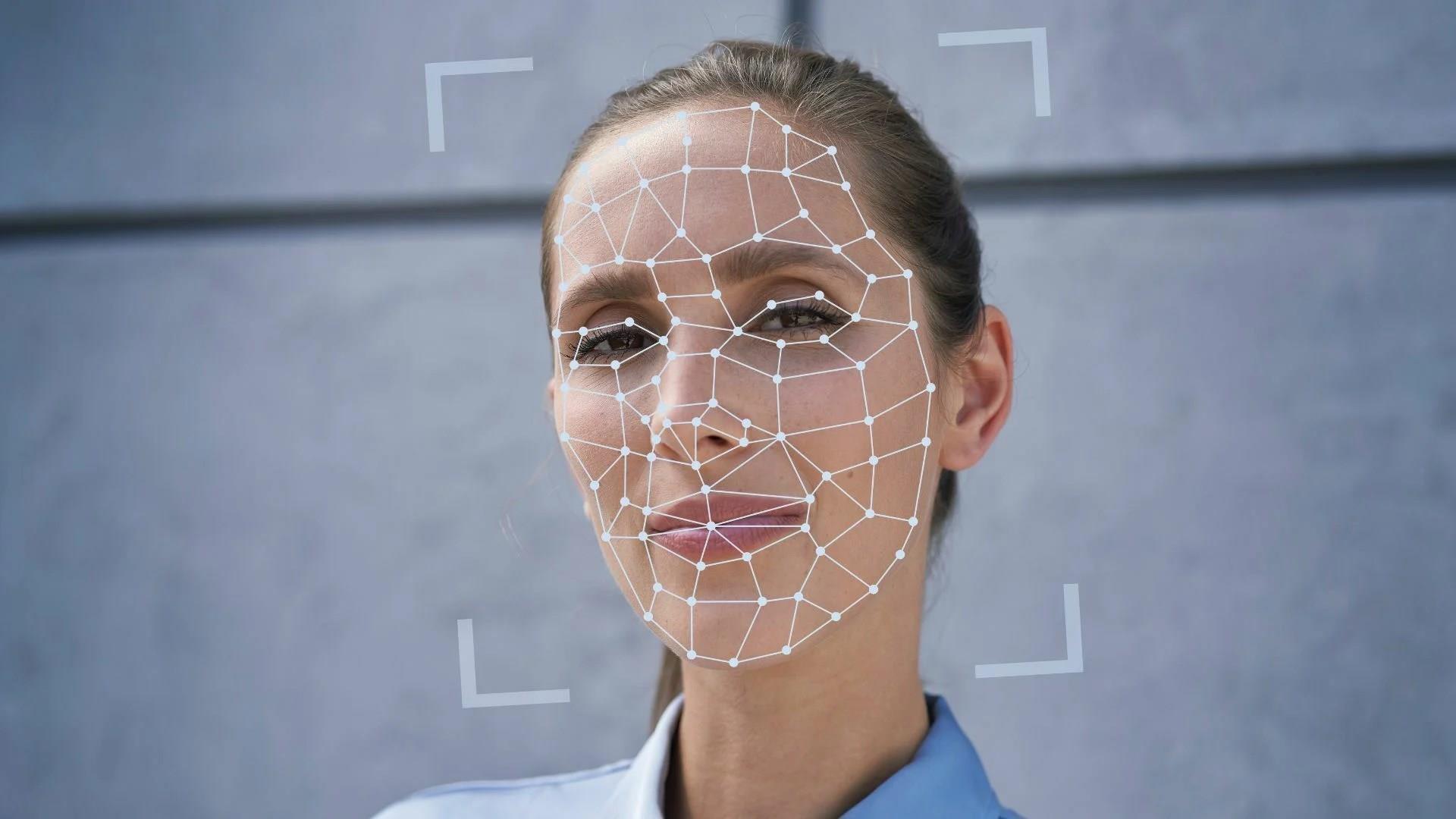

- Sensors and Imaging Systems: Incorporation of cameras, thermal imaging, infrared sensors, and LiDAR enhances environmental perception and threat detection capabilities.

- Artificial Intelligence (AI) and Machine Learning (ML): These technologies enable robots to analyze sensor data, identify patterns, and autonomously respond to security threats.

- Autonomous Navigation: Advanced algorithms facilitate independent navigation through complex terrains, obstacle avoidance, and adaptation to dynamic conditions.

- Communication Systems: Integration with Internet of Things (IoT) devices allows for real-time data exchange and coordinated responses within security networks.

Global Benchmarks

Several companies have set industry standards with their security robot deployments:

- Knightscope: An American firm specializing in Autonomous Data Robots (ADRs) for monitoring public areas. Their robots are equipped with sensors capable of detecting weapons, reading license plates, and identifying suspicious activities.

- Boston Dynamics: Known for developing advanced robots like Spot, which can be adapted for security and surveillance tasks, offering enhanced mobility and real-time monitoring features.

- Hikvision: A Chinese company that has launched surveillance robots with advanced AI capabilities for improved threat detection.

Market Size and Growth

The global security robots market has experienced significant growth:

- In 2022, the market was valued at approximately USD 31.5 billion.

- Projections indicate an expansion to USD 160.8 billion by 2032, reflecting a compound annual growth rate (CAGR) of 17.9%.

- North America held a dominant market share of around 51% in 2022, with the Asia-Pacific region expected to witness a CAGR exceeding 20% from 2023 to 2032.

These figures underscore the escalating demand for autonomous security solutions globally.

1.2 China Snapshot

Market Position and Domestic Capabilities

China has emerged as a significant player in the security and surveillance robots sector:

- Market Share: The Asia-Pacific region, led by China, is anticipated to experience rapid growth in the security robots market, driven by technological advancements and increased defense investments.

- Core Components: Chinese manufacturers have developed capabilities in producing essential components such as sensors, AI algorithms, and autonomous navigation systems, reducing reliance on imports.

Leading Firms and Deployments

Several Chinese companies have made notable contributions:

- Hikvision: Introduced surveillance robots with advanced AI for enhanced threat detection.

- DJI: Expanded its product portfolio to include advanced surveillance drones tailored for security applications.

- DEEP Robotics Company: Launched the X30 quadruped robot designed for various fields, including power station inspection, pipeline corridor inspection, factory inspection, fire detection, emergency rescue, and scientific research.

National Policies and Industrial Targets

The Chinese government has implemented policies to bolster the robotics industry:

- Made in China 2025: A strategic plan aiming to upgrade the manufacturing sector, with robotics identified as a key area for development.

- Guiding Opinions on the Development of the Robot Industry (2021-2025): Issued by the Ministry of Industry and Information Technology (MIIT), this policy outlines goals for innovation, quality improvement, and international competitiveness in the robotics sector.

Cost-Performance Edge and Application Scaling

China's competitive advantage lies in its ability to produce cost-effective yet high-quality security robots, facilitating widespread adoption across various sectors, including:

- Public Safety: Deployment in urban surveillance and law enforcement.

- Industrial Security: Monitoring and safeguarding critical infrastructure and manufacturing facilities.

- Emergency Response: Utilization in disaster relief and hazardous environment monitoring.

Alignment with National Goals

The integration of security robots aligns with China's broader objectives:

- Smart Cities Initiative: Enhancing urban management and public safety through advanced technologies.

- Industrial Upgrading: Transitioning to high-tech manufacturing and automation.

- Aging Population: Addressing labor shortages and ensuring safety in elder-care facilities.

These initiatives underscore the strategic importance of security robots in China's socio-economic development.

1.3 Market Size

Global Market Estimates

The security robots market is poised for substantial growth:

- Acumen Research and Consulting: Projects the market to reach USD 160.8 billion by 2032, with a CAGR of 17.9% from 2023 to 2032.

- Precedence Research: Estimates the market will attain USD 76.67 billion by 2034, reflecting a CAGR of 15.13% from 2024 to 2034.

- Grand View Research: Reports that North America dominated the market with a 37.5% share in 2023, attributing growth to increased emphasis on enhancing security measures across various sectors.

China-Specific Estimates

While specific figures for China are less frequently reported, the Asia-Pacific region, with China as a major contributor, is expected to witness rapid growth:

- Verified Market Reports: Indicates that Asia Pacific held a 35% revenue share in the surveillance robots market in 2023, with expectations of continued rapid adoption driven by technological advancements and increasing defense investments.

Growth Scenarios

The market's trajectory can be influenced by several factors:

- High Growth Scenario: Accelerated adoption due to technological breakthroughs, favorable regulatory environments, and heightened security concerns.

- Medium Growth Scenario: Steady growth driven by gradual technological advancements and moderate adoption rates across sectors.

- Low Growth Scenario: Slower expansion resulting from regulatory challenges, technological limitations, or economic downturns.

Market Segmentation

The security robots market can be analyzed through various lenses:

- By Application Domain:

- Defense and Military: Dominant sector due to ongoing security concerns and defense investments.

- Commercial: Growing adoption in retail, corporate offices, and public spaces.

- Industrial: Utilization in monitoring critical infrastructure and manufacturing facilities.

- By Customer Segment:

- Government: Significant investments in surveillance technology for border security, law enforcement, and disaster management.

- Private Sector: Increasing deployment in corporate security and asset protection.

- By Geography:

- North America: Leading market share with substantial investments in security technologies.

- Asia-Pacific: Fastest-growing region, driven by technological advancements and increased defense spending.

- Europe: Steady growth with emphasis on public safety and infrastructure security.

This comprehensive analysis highlights the dynamic nature of the security and surveillance robots market, underscoring its strategic significance in enhancing global security infrastructure.

AGP Insights

Download PDF.

Your PDF report was sent successfully to your inbox!

Related Insights.