Asia’s Chip Race: Reshaping the Global Semiconductor Ecosystem

Introduction: The Evolving AI Chip Landscape in Asia

The semiconductor industry is at an inflection point, with global dynamics shifting as nations race to secure technological sovereignty and leadership in AI-driven computing.

While the United States tightens restrictions on chip exports to China, Asian countries are working to develop their own AI chip ecosystems.

This transformation is being driven by a mix of necessity, strategic investment, and geopolitical pressure. Countries such as China, South Korea, Malaysia, or Singapore are taking significant steps to build domestic semiconductor capabilities, not only to mitigate reliance on third-party technologies but also to position themselves as key players in the future of AI computing.

Huawei’s Yield Breakthrough: A Challenge to Nvidia’s Dominance

A significant milestone in this shift is Huawei’s recent achievement in improving the yield of its Ascend 910C AI chips. Over the past year, Huawei has doubled the proportion of functional chips in each production batch from 20% to nearly 40%, making its AI chip production line profitable for the first time. Partnering with SMIC, China’s largest semiconductor foundry, Huawei aims to increase this yield further to 60% in the near future (source: Financial Times).

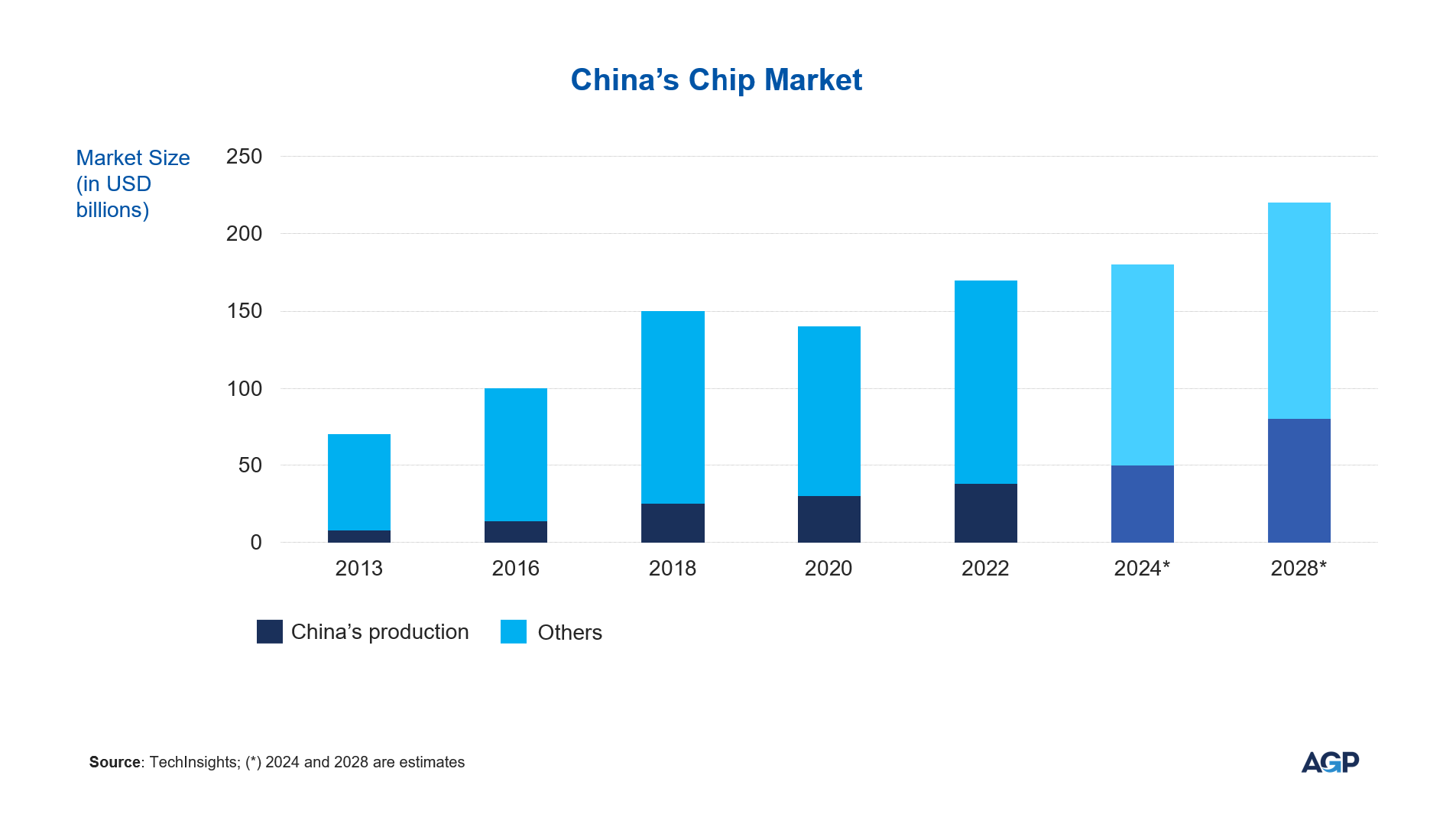

This progress is particularly notable given the restrictions placed on China’s access to advanced semiconductor manufacturing tools. The U.S. government had hoped that export controls would stifle China’s chipmaking capabilities, but instead, they have accelerated domestic innovation. China remains one of Nvidia’s most crucial markets: estimates are that last year Nvidia sold US $12 billion from 1mn H20 AI chips to China, which would represent about 10% of the company's global revenue. However, with major Chinese tech companies like Baidu and ByteDance increasingly adopting Huawei’s AI chips, Nvidia faces growing competition in the Chinese market, which may influence its long-term position and strategic approach in the region.

Malaysia’s Ambition: Building a Homegrown GPU Industry

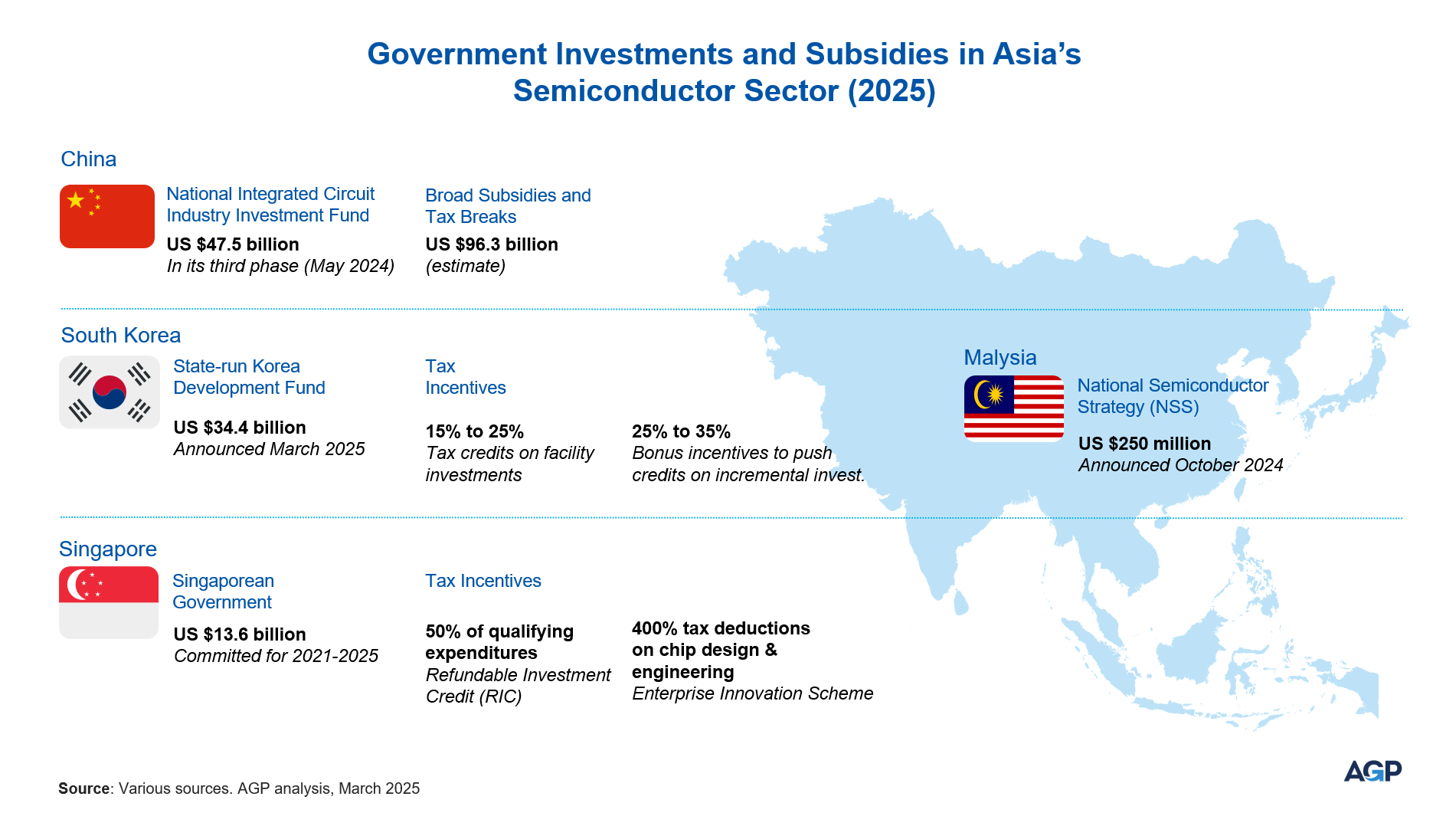

Malaysia, traditionally a major player in semiconductor assembly and testing, is now making a move into chip design. The Malaysian government has committed US $250 million over the next decade to acquire chip design blueprints from Arm Holdings PLC. This initiative aims to develop a domestic GPU production industry within five to ten years.

Beyond chip design, Malaysia announced in March 2025 its plans to train 10,000 engineers, as part of a government initiative aimed at strengthening the country's position in AI and data center technologies. This investment reflects Malaysia’s ambition to become a key supplier for AI and data center technologies in Southeast Asia.

Global technology giants have made significant investments in Malaysia's digital infrastructure, underscoring the country's emergence as a hub for semiconductor innovation. In May 2024, Microsoft announced a US $2.2 billion investment over the next four years to expand cloud computing and artificial intelligence services in Malaysia; in December 2023, Nvidia partnered with Malaysian conglomerate YTL Power International to develop artificial intelligence infrastructure valued at approximately 20 billion Malaysian ringgit (US $4.3 billion).

South Korea’s $34 Billion Bet on Semiconductor Leadership

Meanwhile, South Korea is also implementing significant measures to strengthen its semiconductor sector. The state-run Korea Development Bank has launched a US $34 billion fund to support strategic industries, with semiconductors as a top priority. This fund, which will provide low-interest loans and equity investments over the next five years, is part of a broader effort to maintain South Korea’s competitiveness in AI chips, electric vehicles, biopharmaceuticals, and aerospace.

This initiative builds on an earlier US $18.4 billion investment by the South Korean government aimed at developing key industries, particularly semiconductors. South Korea is home to leading semiconductor giants like Samsung and SK Hynix, which are already global leaders in memory chips. However, the new funding suggests a push to strengthen their position in AI chip design and fabrication.

Singapore’s Strategic Investments in Semiconductor Innovation and R&D

Singapore has made semiconductors a pillar of its innovation strategy. The government committed US $13.6 billion for 2021–2025 toward R&D and capacity-building in electronics and semiconductors.

This includes generous grants for research, infrastructure upgrades, and tax incentives to lower business costs. Notably, Budget 2024 introduced a Refundable Investment Credit (RIC) scheme covering up to 50% of qualifying expenditures (e.g. equipment, facilities, training costs) for advanced manufacturing projects, effectively subsidizing half of companies’ eligible semiconductor capital investments.

Singapore also enhanced its Enterprise Innovation Scheme, offering 400% tax deductions on R&D and innovation spending (capped at US $300k annually) to encourage chip design and engineering breakthroughs.

These policies, alongside a highly skilled workforce and stable business climate, have helped draw major fabs and chip R&D centers to Singapore.

Supply Chain Fragmentation: Risks and Opportunities

The rapid evolution of Asia’s AI chip industry also highlights broader trends in global supply chain fragmentation. As countries push for self-reliance in semiconductors, the traditional model of globalized chip production—where design, manufacturing, and assembly are spread across multiple countries—is being challenged.

The European Union has launched several initiatives to bolster its semiconductor and AI sectors, with investments that align with the European Chips Act, enacted in September 2023. It aims to enhance Europe's competitiveness and resilience in semiconductor technologies, mobilizing over 43 billion euro (US $46.4 billion) in public and private investments.

These shifts present both risks and opportunities. On one hand, increased localization could lead to redundancies, inefficiencies, and higher costs. On the other, it fosters greater supply chain resilience, reducing vulnerabilities caused by geopolitical tensions or unexpected disruptions (such as the COVID-19 pandemic). Countries that successfully develop robust domestic semiconductor ecosystems could gain a strategic advantage in the coming years.

Asia’s Evolving Role in the Semiconductor Industry

The semiconductor industry's competitive landscape is undergoing fundamental transformation as artificial intelligence processing requirements escalate.

Accelerated advancements across Asia signal the rise of credible competitors in specialized fabrication processes and adaptive chipset configurations.

While questions remain regarding whether current initiatives can bridge the innovation gap with established industry leaders, AI chip development has transitioned from dominance of a few players to multipolar competition. This strategic realignment is gradually redistributing manufacturing influence and technological specialization across Asia.

Related Insights.