How to enter Chinese markets with IoT solutions

Why is China an important market for IoT solutions?

In 2009, the Chinese government designated the adoption of the Internet of Things as a priority, leading to state support for research and development, as well as infrastructure investment, as the country sought to digitalize its economy. This early investment in IoT has led China to become a world leader in adoption and the second-largest market after the US. At the end of 2020, China’s IoT industry had an estimated value of $375.8 billion (Ministry of Industry and Information Technology).

The state's subsidies for investment to digitalize the industrial sector is a significant boost to China's IoT market. Meanwhile, China has taken a leading role in the rollout of supporting infrastructure such as 5G base stations. By one estimate, China accounted for three-quarters of cellular IoT connections worldwide at the end of 2020. The US network technology leader Cisco projects that by 2023 China will lead globally in 5G connections. This rapid progress in developing connectivity infrastructure is encouraging China's appetite for IoT applications.

China is also becoming a global leader in the deployment of AI solutions in use cases such as machine vision, collaborative robots, and predictive maintenance despite lagging the USA in primary research and AI frameworks.

A historical characteristic that strengthens the Chinese market for digital solutions is the massive scale of investment in production, logistics, and transportation equipment and infrastructure over the past thirty years. These investments were made during a period of rapid growth so efficiency was less important than capacity. As China's economy matures and growth slows, the focus is shifting from scale to efficiency. This presents an enormous opportunity for technology companies that are able to improve asset efficiency and extend the lifecycle of equipment and infrastructure.

Unique characteristics of the market

The Chinese market is highly complex with significant differences in market behavior across industries, provinces, and market tiers. Companies require a serious forward-planning effort to effectively enter the market with digital solutions. For example, the labor cost in coastal production hubs can be twice that of inland provinces. And market tiers range from global leaders investing in cutting edge solutions to the mass market of SME businesses using mid-20th century technologies and processes.

When we think of ways in which to target a customer base, we must also consider the ways in which local buyer journeys differ from customers outside of China. Decisions tend to be more highly centralized among Chinese firms. And procurement processes differ between private firms and state-owned enterprises to must adhere to national anti-corruption standards.

Your business model is particularly important. SaaS adoption remains significantly less mature in China than in Europe and North America, especially among state-owned enterprises. Companies may need to design a new revenue model, which takes into account the procurement preferences of their Chinese customer base.

Since no company operated in a vacuum, it is also critical to observe the competitive landscape in China. Both local and foreign competitors can influence the decision of which segments to target. They may also be important allies in educating a market in the case of new technologies in which awareness of the value proposition is limited.

Four critical areas to consider when localizing your digital business in China

For an international company that is seeking to enter the Chinese market with digital solutions, localizing your business can be a tricky process. At IoT ONE, we prioritize four critical areas that your company should focus on:

1. Product Strategy:

You should also be asking yourself, what ‘whole product’ differentiation gives you a competitive advantage? We help companies to assess market segmentation, business objectives, competitor strategies, and China’s tech landscape to guide product localization.

2. Revenue Model:

When considering a move into the Chinese market, you should consider how your revenue model can maximize growth, customer retention, and profitability? A detailed understanding of how customer value is delivered, how the customer perceives your product, and sales scenarios will guide your revenue model localization.

3. Prospecting Strategy:

When localizing for China, it is important to ensure that you are prioritizing the right customers and engaging with them effectively. The Chinese market has its own unique buyer journeys, buyer personas, value propositions, and prospecting strategies, which are all oriented around the prioritization of customer segments and use cases.

4. Distribution Channel:

Finally, how can you achieve superior distribution in competitive markets which can give you an edge over other companies? Driving growth with a lean sales force requires an effective channel strategy and a highly motivated partner ecosystem.

These four critical areas provide a reference framework to consider when planning your entry into the Chinese market. These areas can also be broken down further into eight market entry factors that define localization requirements and help to build a bullet-proof entry plan.

Under the product strategy umbrella, we consider the following three topics: Which segments have the most potential for scale in the long term?

Customer Segments & Demand

Here we must ask ourselves the following questions:

- Which segments have the sharpest demand in the near term? Do they already use similar solutions?

- What segments have the greatest potential to scale in the long term? Which are the least price sensitive?

- What specific objectives and pain points are mentioned in customer interviews? Do they differ from the European or North American markets?

- Have specific customers indicated an interest in purchasing the solution? Do they have specific requirements?

- What characteristics define customers or partners that demonstrate strong interest?

UI / UX Requirements

When considering User Interface and User Experience design, we can ask ourselves the following questions:

- What is the education and experience level of users?

- Does the UI need to be simplified for the Chinese market?

- Are there specific local UI or UX requirements?

- How do the UI and UX of local competitors differ?

- Do the underlying business processes differ due to local regulations or business practices? If so, how will these impact the UX?

Solution Tech Stack

Finally, within the product strategy umbrella, we must explore the solution tech stack:

- Does the data management architecture need to be localized due to regulatory or usability issues?

- Would sourcing local hardware make sense to improve profit margins?

- Do APIs or other components of the solution need to be localized?

When selecting the revenue model that you will adopt for the Chinese market, options for pricing model and level should be considered:

Pricing Model

- Here we consider how your pricing model will be received by the Chinese market. For example:

- Will your target segment of Chinese customers accept an annual subscription model? If not, what pricing model is preferred?

- Are there standard procurement or accounting practices that present barriers to the existing pricing model?

- Are the subsidies that are structured to support one pricing model over another?

- What is the risk profile of your pricing model given the expected customer retention level?

Pricing Level

- Similarly, we should consider the pricing level within the Chinese market and how that can be applied to your product.

- What price level will your market segments accept? What values is the market willing to pay a premium for?

- If the price must be reduced, where can costs be reduced via localization to maintain margins?

- What are the pricing model and level of local competitors?

- Will local customers pay a premium for certain elements of your offer (e.g., premium hardware) but expect a discount on other elements (e.g., aftersales service)?

We next consider the prospecting strategy:

Buyer Decision Process

Here are some questions to ask yourself when considering how buyers make decisions about your product.

- Who are the primary buyers? Who are decision influencers?

- What is the sourcing and procurement decision-making process in China? How does it differ from your home markets and across customer segments?

- When in the buying process are you likely to become aware of the need? How can you learn of the need earlier?

- Are there ethical or regulatory considerations that you must take into account to protect your company?

Value Proposition & Messaging

Here we consider your product’s value proposition and how it is communicated to customers.

- Which aspects of the offer are most attractive to target customer segments in China?

- How does the current value proposition and offering differentiate from Chinese competitors? What messaging resonates?

- How does the value proposition align with the next 5-year plan?

Finally, under the distribution channels umbrella, we can consider internal and external distribution models:

Internal Distribution Model

Internal sales teams can be expensive to build in China due to the country's large size but are often necessary for selling technical solutions.

- If you have an existing sales force in China that supports a different business unit or product family, can it be used to support this digital offering?

- Can you sell the solution remotely or with a minimal number of onsite visits, or is a regular presence at the customer site required?

- Which geographies should you focus internal sales teams on?

- How should your incentive model be defined?

- What is the right mix between sales and technical competencies in your internal sales team?

External Distribution Model

Many technology providers rely on external distribution channels for the majority of their sales in the Chinese market. The structure of these channels depends on several factors.

- Which resellers are relevant for the target segments?

- Are traditional channels, e-commerce channels or VARs likely to be most effective?

- How does the role of integration partners differ in China? Should multinational or local players be prioritized as partners?

- How many channel partners are needed to address the majority of the market?

- What incentive structure is most effect for prioritized channels?

- What marketing materials and technical support do partners require to be effective at sales?

The process of conducting market research in China

With all of these considerations in mind, we can move on to discuss best practices when conducting market research in China. When conducting market research in China, we generally start with the product and related use cases.

In China's rapidly evolving markets, it is wise to conduct frequent market research to guide your product portfolio strategy in order to adapt to changing market demands and competitive dynamics.

Market research can help your business stay ahead of the product lifecycle and the changing market environment.

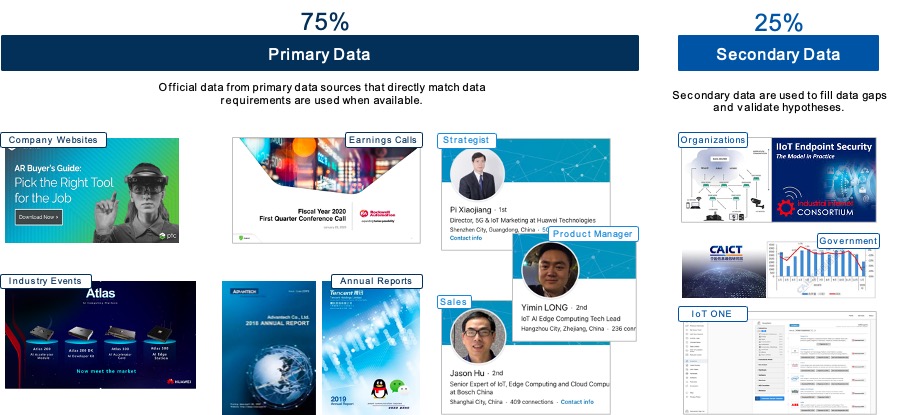

High-quality standardized reports are less available in China than in more mature markets. As a result, primary research such as telephone interviews, customer workshops, and surveys should generally make up 75% of the research effort. The other 25% will focus on secondary research, such as customer websites, white papers, press releases, government reports and other sources.

The evaluation of your product portfolio takes shape in four areas:

Market Segmentation

When thinking about market segmentation, we should consider who your target customers and are how do they differ? We can consider the following points:

- Mature vs. growth segments

- Functional requirements

- Service requirements

- Technical capability

- Pricing elasticity

- Geographic location

- Market consolidation

Technology Landscape

Within this point, we consider how relevant technologies are changing?

- Government regulations

- Government incentive policies

- Evolution of core technologies

- Evolution of complementary technologies

- Disruptive innovation

- Local substitutes for global 'best in class' solutions

Business Objectives

What are your near, medium, and long-term objectives?

- Market share vs. profitability

- Entry into new regions or segments

- Strengthening an existing portfolio

- Building a defensive moat against emerging competitors

Competitive Benchmarking

Who do customers compare you against in an RFQ?

- Traditional competitors

- Emerging competitors such as startups

- Substitute products

- System integrators with customized solutions

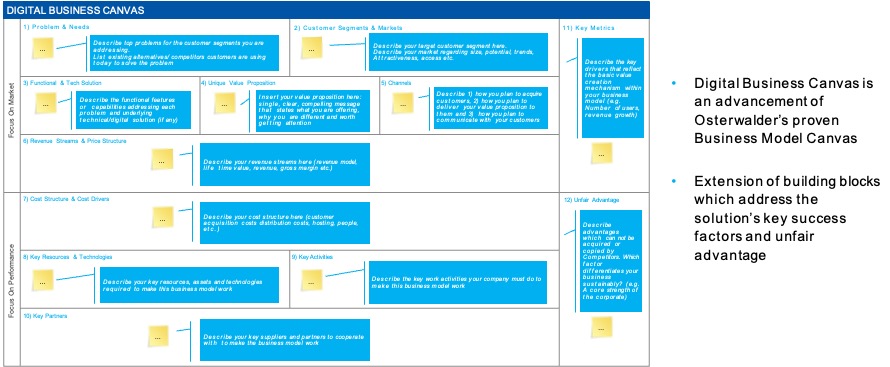

This analysis will then enable you to map a localized version of your digital business canvas for China.

The digital business canvas provides a basis for your market entry roadmap, which outlines business localization and engagement with initial customers and partners.

A typical market entry plan focuses on three factors:

- P&L Projections: P&L projections clarify potential gains for confident go / no go decisions.

- Activities List: Activities list details actionable items from our research and analysis for teams to easily execute.

- Market change factors: Market change factors should be monitored and controlled to facilitate favorable macro environments for growth.

Building prospecting strategies helps to define your customer base, buyer personas and value propositions, IoT ONE takes a five-step approach:

Step 1: Which use cases are the most relevant for influential buyers?

Step 2: Who makes or influences purchase decisions for the use case?

Step 3: Buyer Personas – What are the objectives and decision factors for the key buyers and influencers?

Step 4: Value Proposition – What objectives will the buyer pay a premium to achieve for each use case?

Step 5: Prospecting Strategy – How can the unique value be powerfully communicated?

Finally, when designing the market entry plan, we aim to scale digital product sales by using a segmented channel strategy that is designed to win specific niches before scaling.

Most relevant IoT solutions in the Chinese market

In 2015, the Chinese government outlined its plans to develop the country’s industrial capabilities in its Made in China 2025 plan. Despite the name, this plan outlined the goal of becoming a global manufacturing quality leader by 2045. The year 2025 was simply the first sprint. In the years since the Made in China 2025 received negative international press and the government has issued fewer policy updates. Nonetheless, the strategy remains in place and is a significant driver of IoT adoption in China.

Another important policy is Internet Plus, which encouraged the application of Internet technologies across traditional sectors, with an emphasis on smart cities, smart homes, smart grids, healthtech, smart car applications and retail. Together the Made in China 2025 and Internet Plus policies provide a blueprint for IoT adoption.

Building a successful business in Chinese markets

The cost of doing business in China can be high in the major cities when office rental, labor costs, training, and establishing distribution channels are taken into account. Companies should be ready to commit for multiple years before turning a significant profit, especially with technical solutions that are early in their product lifecycle.

In order to assess the viability of the market we recommend taking both top-down and bottom-up perspectives. This will reduce the risk of a failed investment.

1. Top-Down Market Research

Understand the market potential and significant growth drivers or barriers:

- Total addressable market size

- Market growth rate

- Government policies

- Potential by market segment

- Major market players / key competitors

2. Bottom-Up Market Research

Validate the market potential by focusing of specific niches and customers:

- Total available market size

- Target customer list

- Interviews to assess customer readiness in target segments

- Solution benchmarking against primary competitors

3. Segmentation and Prioritization

Prioritize initial market segments for development:

- Segment size (aggregate revenue, number of companies)

- Adoption readiness

- Current solution penetration

- Potential win rate

- Localization requirements

4. Obtainable Revenue Estimation

Project capturable revenue by with scenario analyses across the sales funnel:

- Available market size of target segments

- Leads contacted

- Leads engaged

- Proposals

- Win rate for pilot / first sale

- Scale rate for full deployment

- Retention rate over time

Vodafone making IoT inroads in China

In one of the more famous examples of an overseas IoT solutions provider entering the Chinese market, Vodafone made a landmark deal with China Mobile that gave it access to the country’s IoT users.

Vodafone is one of the biggest IoT companies in the world but it could not sell directly in China due to the country's policies. The company made a savvy move by partnering with one of China’s biggest telecommunications providers in order to gain access to the country’s huge market for its IoT solutions. The partnership was significant in that it established a cross-border partnership in which both companies were given access to new markets, representing an equitable global partnership with a Chinese company.

The IoT industry in China is booming. Yet the promise of the market for international IoT solution providers is tempered by the complexity of market entry. To increase the probability of success, it is imperative to diligently assess market fit, and then define a clear, multi-step process for launching your product in perhaps the most exciting IoT market in the world.

Related Insights.