2025: SEA Startups Refocus on Profitability Amid Investor Caution

A New Funding Landscape

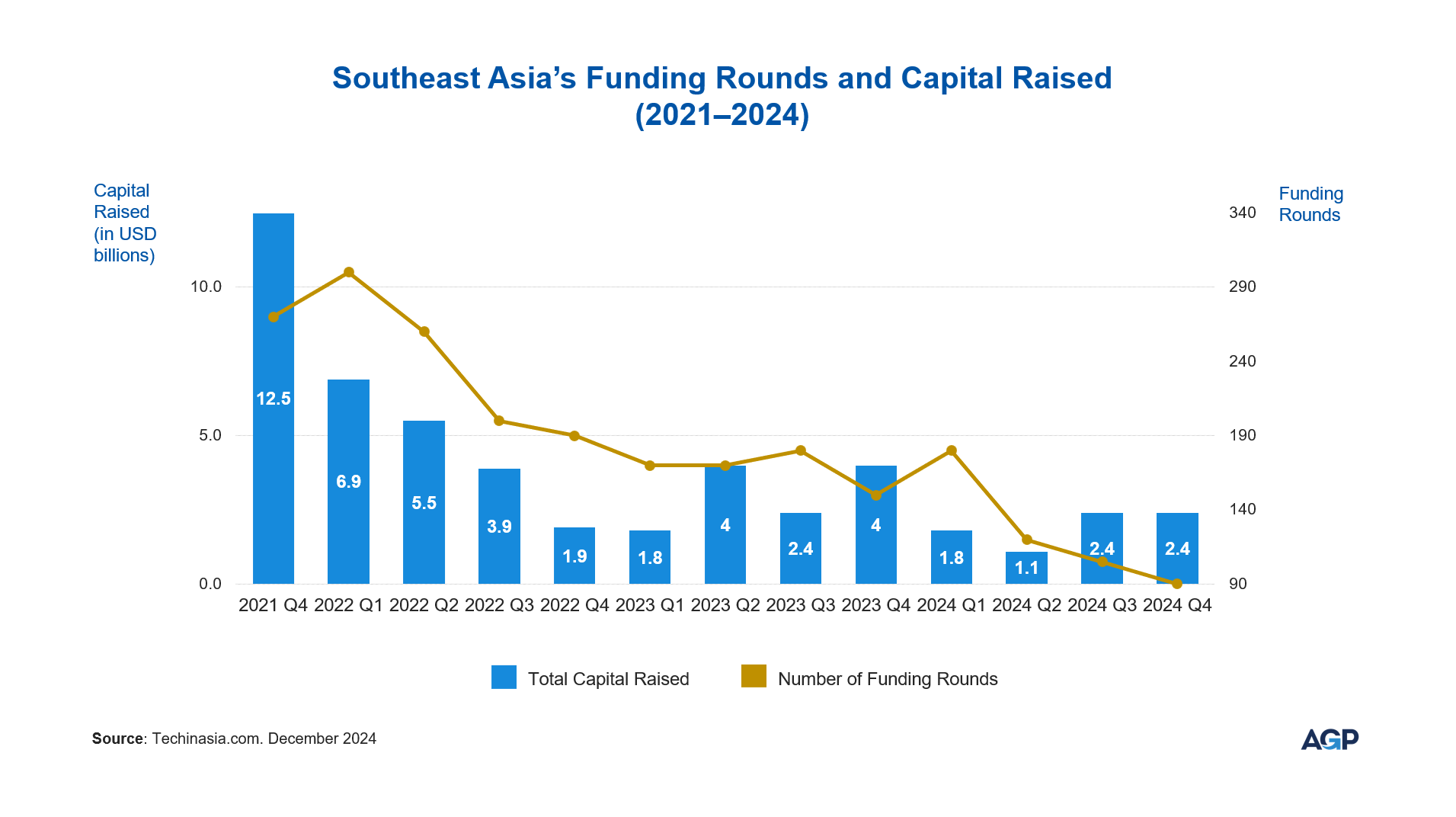

Funding in Southeast Asia has dropped to its lowest point in four years, with an estimated capital raised of 7.7 USD billion in 2024 (down from 12.2 USD billion in 2023), reflecting a broader global trend of tightening capital.

Southeast Asia experienced a surge in startup funding in 2021, driven by a low-interest rate environment and a rapid expansion of digital services during the COVID-19 pandemic. However, activity has since declined as nations, including the U.S., increased interest rates.

Startups accustomed to relatively quick funding cycles now face longer and more rigorous processes, with investors focusing on operational efficiency and profitability.

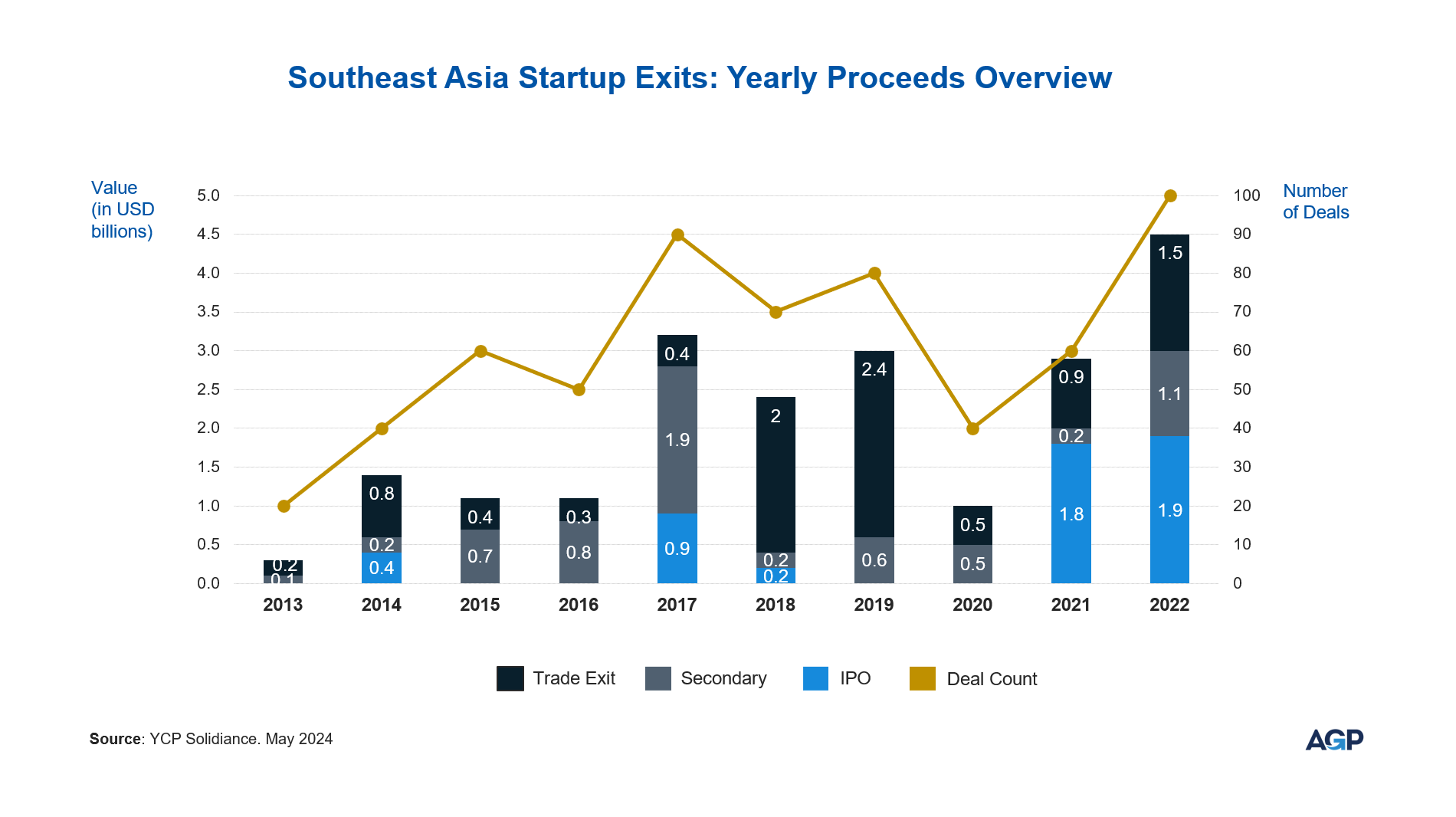

Venture capitalists, meanwhile, are seeking exits for investments made nearly a decade ago. Secondary markets have become an increasingly popular avenue, though stakes are often sold at significant discounts—30% to 40% below peak valuations. The environment for initial public offerings (IPOs) and acquisitions remains subdued, adding further complexity to funding strategies.

Challenges for Startups Across Stages

The funding crunch has affected startups differently, depending on their stage of development:

- Early-Stage Startups (Seed to Series B): Valuations for early-stage companies have remained relatively stable, but fewer deals are being made as investors seek higher returns or discounted terms. Competition for funding has intensified, and securing investment now requires clear pathways to profitability.

- Growth-Stage Startups (Series C and Beyond): Companies that prioritized scaling over profitability face greater challenges. Many must accept lower valuations, restructure operations, or significantly adjust growth expectations to attract funding.

Shifting Priorities and Operational Adjustments

The pivot from growth to profitability is driving startups to reassess their strategies. Overly optimistic projections about market size and purchasing power have led to a reevaluation of customer acquisition models and spending patterns. Companies have implemented cost-cutting measures, including layoffs, to extend financial runways and adapt to the new environment.

Investors are also recalibrating their approach. Traditional revenue-based valuation metrics are being replaced with profitability-focused measures, such as EBITDA multiples. Negotiation strategies are evolving, with differential pricing—a method that customizes valuations for individual investors—emerging as a practical way to manage varied stakeholder expectations.

Opportunities for Strategic Investors

Despite the challenges, the current environment offers opportunities for investors. Discounted valuations in secondary markets provide an entry point for those with a long-term view, especially in early-stage startups with strong fundamentals.

However, these opportunities require rigorous due diligence to ensure the underlying business models can deliver sustainable returns.

Outlook for the Ecosystem

The funding environment in Southeast Asia is expected to remain difficult in the near term, and it could take two to three years before the region’s startup ecosystem sees significant recovery.

Startups must focus on extending their financial runways and demonstrating operational discipline to attract cautious investors. Meanwhile, investors will need to balance prudence with strategic risk-taking to identify ventures capable of navigating the current landscape.

A Shift in Approach

Southeast Asia’s startup ecosystem is transitioning from an era of growth-driven investment to one where financial sustainability is paramount. For startups and investors alike, success will depend on adapting to these new priorities, fostering long-term resilience, and identifying opportunities within a more measured investment environment.

This evolving landscape highlights the importance of collaboration, strategic planning, and a focus on fundamentals as the region continues to mature.

Related Insights.