Boosting Pharma Innovation Capacity in China

Multinational pharmaceutical companies are increasingly investing in China to build internal innovation capacity and / or forging external partnerships with Chinese pharma, driven by the country's robust biotech ecosystem, supportive government policies, and advancements in AI and data science.

Chinese Companies in Global Clinical Development

To capitalize on future growth prospects, numerous pharmaceutical MNCs are now actively exploring collaborations with Chinese pharma organizations.

Recent data from Stifel’s Tim Opler (January 2025) reveals that pharmaceutical companies are turning to China as a key source of externally developed innovation, acquiring roughly one-third of their in-licensed drug candidates from China, a notable rise from the 10%-12% range seen between 2020 and 2022.

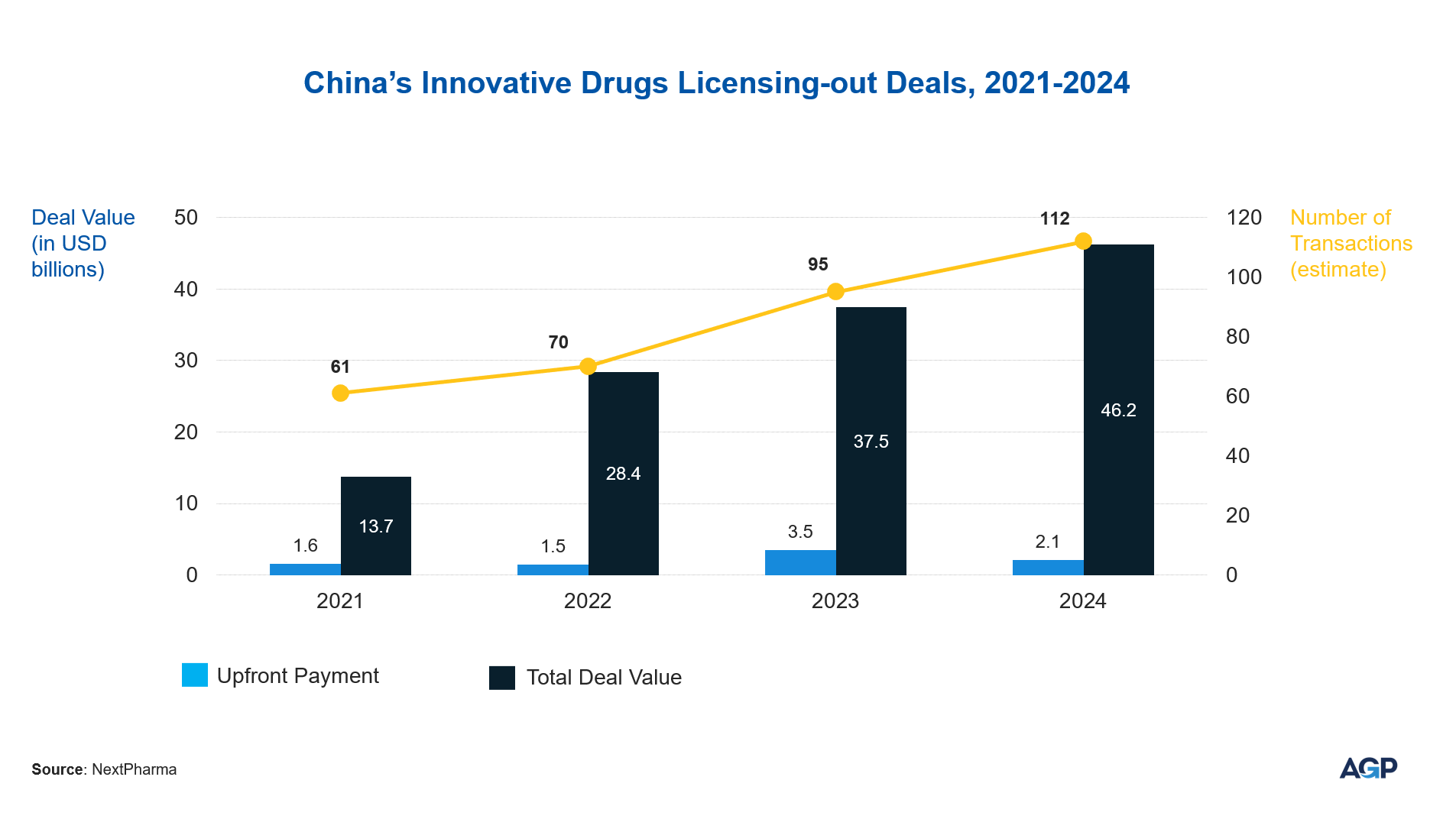

The value of out-licensing deals continued to climb in 2024, reaching approximately $46.2 billion, up from $37.4billion in 2023 and $28.4 billion in 2022.

Companies like Merck & Co. have recently secured multiple China-developed therapies still in the early or preclinical stages, while peers such as Novartis have followed with comparable agreements. In November 2024, Merck announced an exclusive global license to develop, manufacture and commercialize LM-299, a novel investigational bispecific antibody from China-based LaNova Medicines. LaNova will receive an upfront payment of +$588 million. Novartis partnered with Shanghai Argo Biopharma for next-gen RNAi therapeutics with an upfront payment of $185 million.

Building upon this positive trend, prominent venture capital firms like Bain Capital Life Sciences and RTW Investments have stepped up their investment activities in China. Though specific 2025 deal values are not disclosed, Bain Capital has made active investments in Chinese biotech firms, such as Tenacia Biotechnology, which focuses on innovative treatments for central nervous system disorders. In 2025, RTW led a $127 million equity investment in JIXING Pharmaceuticals, alongside Bayer’s $35 million, supporting JIXING’s clinical-stage pipeline in cardiovascular and ophthalmology.

AstraZeneca's Strategic Investment in Beijing

AstraZeneca announced, during the China Development Forum 2025 (March 23–24), a $2.5 billion investment to establish a new global strategic R&D center in Beijing, marking a significant commitment to China's biopharmaceutical sector.

AstraZeneca's investment in Beijing aims to establish its sixth global strategic R&D center and second in China, complementing its existing facility in Shanghai.

The new center will focus on early-stage research and clinical development, supported by a state-of-the-art AI and data science laboratory. This move underscores the growing importance of integrating artificial intelligence (AI) and data science into pharmaceutical research and development (R&D) and highlights China's evolving role as a hub for innovation in the life sciences.

AstraZeneca has also entered into collaborations with local biotech firms, including Harbour BioMed and Syneron Bio, to develop innovative therapies. Additionally, AstraZeneca has formed a joint venture with BioKangtai to develop and manufacture vaccines for respiratory and other infectious diseases, marking its first vaccine manufacturing facility in China.

Pfizer's Expansion Plans in China

Pfizer has also recently reaffirmed its commitment to the Chinese market. In November 2024, it announced plans to invest $1 billion in China over a five-year period to enhance research and development of innovative drugs.

At the 7th China International Import Expo, which took place in November 2024, the company presented its “China 2030 Strategy”. It outlined the company’s commitment to boosting innovation, advancing diagnostics and treatment standards, and fostering growth within the local biotech ecosystem from 2025 through 2030. The initiative aligns with China’s national “Healthy China 2030” agenda, supporting broader efforts to improve public health outcomes and healthcare innovation across the country.

Pfizer plans to submit 24 new drug or indication applications in China by the end of 2025. Furthermore, the longer-term plan is to introduce 60 new medications and treatment indications to the Chinese market by 2030.

Haleon's Full Ownership of Chinese Joint Venture

British consumer healthcare company Haleon acquired full ownership of its Chinese joint venture, Tianjin TSKF Pharmaceutical Co., by purchasing the remaining 12% stake held by Tianjin Pharmaceutical Da Ren Tang, in April 2025.

This move allows Haleon to have greater control over its operations in China and aligns with its strategy to strengthen its presence in the Chinese consumer healthcare market, a market identified as having exceptional growth potential, and to capitalize on rising demand for consumer healthcare products.

With TSKF producing and distributing leading brands such as Fenbid, Voltaren, and Bactroban, Haleon can better leverage these assets to capture additional market share in high-growth categories like pain relief and wound care.

XtalPi's AI-Driven Drug Discovery

XtalPi, a Chinese biotechnology company founded by three post-doctoral researchers at MIT - Wen Shuhao, Ma Jian, and Lai Lipeng -, specializes in AI-driven drug discovery and material science, using quantum algorithms and machine learning to accelerate drug discovery.

XtalPi collaborates with a significant portion of the global pharmaceutical industry. It works with hundreds of companies, including 16 of the world’s top 20 pharmaceutical companies, and has engaged in collaborative research with nearly all top-20 pharmaceutical companies.

In February 2025, XtalPi announced a HK$2.08 billion (approximately $267 million) share placement to fund its "AI+ Technology and Industry Integration Innovation Consortium Project" in the Greater Bay Area.

Insilico Medicine's AI-Powered Therapeutics

Insilico Medicine specializes in AI-driven drug discovery. It focuses on developing therapeutics using AI, specifically employing generative chemistry platforms like chemistry and biology engines like PandaOmics. These platforms utilize generative AI, including generative adversarial networks (GANs) and transformer models, to design drug-like molecules from scratch with desired properties.

The company has a significant presence in China and has expanded its operations there to leverage the country's infrastructure and scientific talent, but it maintains a global footprint with headquarters and R&D activities in multiple locations, including the United States and Hong Kong.

In March 2025, Insilico Medicine secured $110 million in Series E financing, prominently led by Chinese investors, including Value Partners Group and Shanghai Pudong Venture Capital. The company announced plans to use these funds to further enhance its AI models, establish and upgrade automated laboratories, and expand its China operations, specifically by setting up its China technology headquarters in Shanghai’s Pudong New Area and deepening partnerships with local enterprises for AI-driven biopharmaceutical development.

China's Supportive Environment for Biopharmaceutical Innovation

China has created biopharmaceutical innovation hubs in ten cities, to foster collaboration and strengthen industrial capabilities. Notably, the Yangtze River Delta (Shanghai, Suzhou, Hangzhou), the Beijing-Tianjin-Hebei region, and the Greater Bay Area (Guangzhou, Shenzhen, Hong Kong) stand out as central to China's biopharma development.

The Chinese government has also invested substantially in biomanufacturing, with plans to double down on investment in 2025 following a $4.17 billion investment in 2024. This commitment aims to bolster the country's capabilities in producing high-quality biopharmaceutical products. This initiative is part of China's broader strategy, highlighted in the 14th Five-Year Plan, which positions biomanufacturing as a key strategic industry for national development and global competitiveness.

Strengthening Global Competitiveness Through China

Multinational pharmaceutical companies are increasingly investing in China to build internal innovation capacity, driven by the country's robust biotech ecosystem, supportive government policies, and advancements in AI and data science.

AstraZeneca's significant investment in Beijing, Pfizer's expansion plans, Haleon's acquisition, and the innovative approaches of companies like XtalPi and Insilico Medicine exemplify this trend.

As China continues to position itself as a global leader in biopharmaceutical innovation, multinational companies that strategically invest and collaborate within this dynamic environment are likely to enhance their R&D pipelines and achieve long-term success in the global market.

For multinational companies aiming to strengthen global competitiveness through China, here are three actionable takeaways:

Anchor R&D Where the Innovation Is Happening: Co-locating with innovation hubs and startups can drastically accelerate learning cycles and global pipeline development.

Forge Smart Local Alliances to Accelerate Global Innovation: Collaborations with AI-driven biotech firms offer a new perspective on R&D. These partnerships will be instrumental in integrating advanced algorithms, predictive modeling, and quantum chemistry into the research process.

Leverage Policy as a Strategic Enabler: Proactive alignment with national strategies like the 14th Five-Year Plan and programs for biomanufacturing excellence can unlock incentives and reduce friction.

Geopolitical Risks

While China’s innovation momentum presents compelling opportunities, multinational companies must navigate an increasingly complex geopolitical environment. In April 2025, the evolving U.S. Biosecure Act continues to cast uncertainty over how U.S. pharma companies engage with Chinese biotech firms, particularly those involved in genomic data, AI-driven discovery, and public health infrastructure.

The Act’s restrictions, though not yet finalized in scope, raise potential challenges for MNCs with dual operations or global data-sharing strategies. As Washington scrutinizes dependencies on Chinese biomanufacturing and digital health platforms, firms operating across both ecosystems must assess risk exposure, supply chain configurations, and data governance frameworks.

Still, companies like AstraZeneca, Pfizer, and Insilico Medicine are demonstrating that strategic engagement remains viable, especially when grounded in localized partnerships, clear IP controls, and strong regulatory compliance.

Multinationals looking to build or expand innovation capacity in China should ensure they have a robust risk-mitigation strategy that balances access to China’s scientific talent pool with geopolitical awareness and global operational resilience.

Related Insights.