AGP China Technology Report - Actuation & Motion Control

Table of Contents

Page Section

03 Technology Overview

06 Historical Development Timeline

08 Product Differentiation

12 China Technology Ecosystem

15 Sino-Foreign Collaboration

19 Common Applications In China

24 Government Policy Support

27 Impact On Market Incumbents

29 Final Conclusion

30 Appendices

1.1 Global Snapshot

Definition and Scope

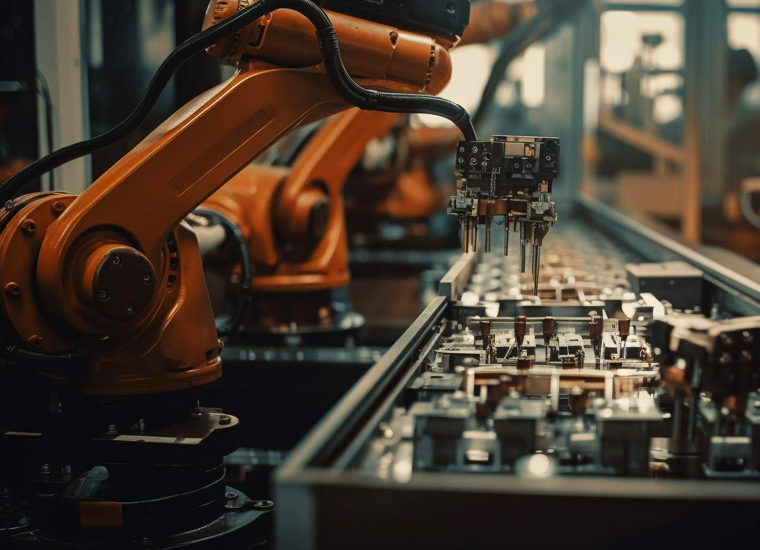

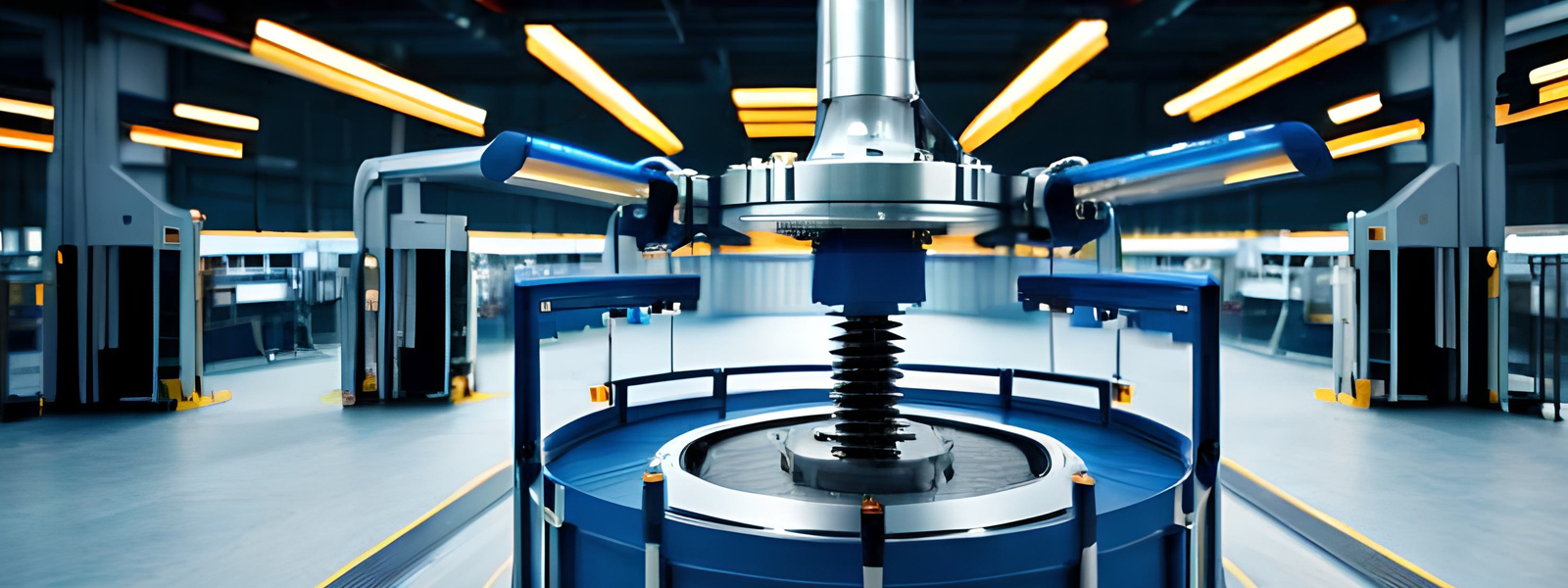

Actuation and motion control technologies are essential for converting energy into mechanical motion and precisely managing mechanical systems across various industries. These technologies encompass electric, hydraulic, and pneumatic actuators, along with sophisticated motion controllers and feedback devices, ensuring high precision and efficiency in operations.

Key Technologies

- Actuators: Convert energy into mechanical motion, vital for controlling movement.

- Motion Controllers: Direct actuator operations based on commands.

- Sensors and Feedback Devices: Monitor performance and provide data for dynamic adjustments.

- Drives and Motors: Supply power and modulate speed and torque.

Global Market Overview

The global motion control market was valued at approximately USD 16.5 billion in 2024 and is anticipated to reach USD 21.6 billion by 2029, growing at a CAGR of 5.5%. This growth is attributed to increasing automation and industrialization globally. Asia-Pacific is the largest market, with North America expected to see the highest growth rate. Leading market players include Siemens AG, ABB Group, and Rockwell Automation Inc.

1.2 China Snapshot

Market Position and Domestic Capabilities

China plays a pivotal role in the global motion control market, supported by a robust manufacturing sector and rapid automation. The country has developed core components, such as high-precision actuators, enhancing its domestic capabilities. Leading Chinese firms, including Estun Automation and Robustmotion, provide competitive products for both domestic and international markets.

Leading Firms and Product Offerings

- Estun Automation Co. Ltd.: Specializes in cost-effective motion control systems and industrial robots.

- Robustmotion: Offers precision motion control systems and electric actuators, widely used in industrial manufacturing.

National Policies and Industrial Targets

The "Made in China 2025" initiative aims to upgrade China's manufacturing sector through automation, promoting intelligent manufacturing. This policy supports the development of high-end manufacturing equipment and encourages widespread adoption of automation solutions.

Cost-Performance Edge and Application Scaling

Chinese manufacturers leverage economies of scale and innovation to achieve a cost-performance advantage, facilitating motion control applications in automotive, electronics, and logistics sectors. This enhances production efficiency and quality, aligning with national goals for industrial upgrading.

Role in Advancing "New Productive Forces"

Motion control technologies are crucial to China's strategy for developing "new productive forces," focusing on innovation-driven growth and high-quality development. These technologies help transform traditional industries and foster new sectors, supporting economic modernization.

Policy Relevance and Tech-Industry Integration

The integration of motion control technologies in China's industrial landscape highlights the importance of supportive policies for technological advancement. Collaboration among government, research institutions, and industry players drives innovation and competitiveness in the global market.

1.3 Market Size

Global and China-Specific Market Estimates

The global market for motion control is projected to grow from USD 16.5 billion in 2024 to USD 21.6 billion by 2029, at a CAGR of 5.5%. In China, the market is expected to expand significantly, propelled by the emphasis on industrial automation and smart manufacturing.

Growth Scenarios

- High Growth: Driven by rapid adoption of automation, robust government support, and swift industrial upgrading.

- Medium Growth: Characterized by steady integration of motion control systems with moderate policy backing.

- Low Growth: Slower adoption due to economic uncertainties and limited policy incentives.

5-Year CAGR Estimates

Projected global CAGR ranges from 4.7% to 5.8% over the next five years, influenced by regional adoption rates and technological innovations.

Market Breakdown

- By Application Domain: Metal cutting, metal forming, material handling, robotics, and others.

- By Customer Segment: Aerospace & defense, automotive, semiconductor & electronics, machinery manufacturing, food & beverages, medical, printing & paper, pharmaceuticals & cosmetics.

- By Geography: Asia-Pacific, North America, Europe, Latin America, and Middle East & Africa.

This segmentation outlines the diverse applications and regional dynamics shaping the motion control market's growth trajectory.

AGP Insights

Download PDF.

Your PDF report was sent successfully to your inbox!

Related Insights.