AGP China Technology Report - Collaborative Robotics (Cobots)

Table of Contents

Page Section

03 Technology Overview

06 Historical Development Timeline

08 Product Differentiation

12 China Technology Ecosystem

16 Sino-Foreign Collaboration

20 Common Applications In China

25 Government Policy Support

28 Impact On Market Incumbents

30 Final Conclusion

31 Appendices

1.1 Global Snapshot

Definition and Key Technologies

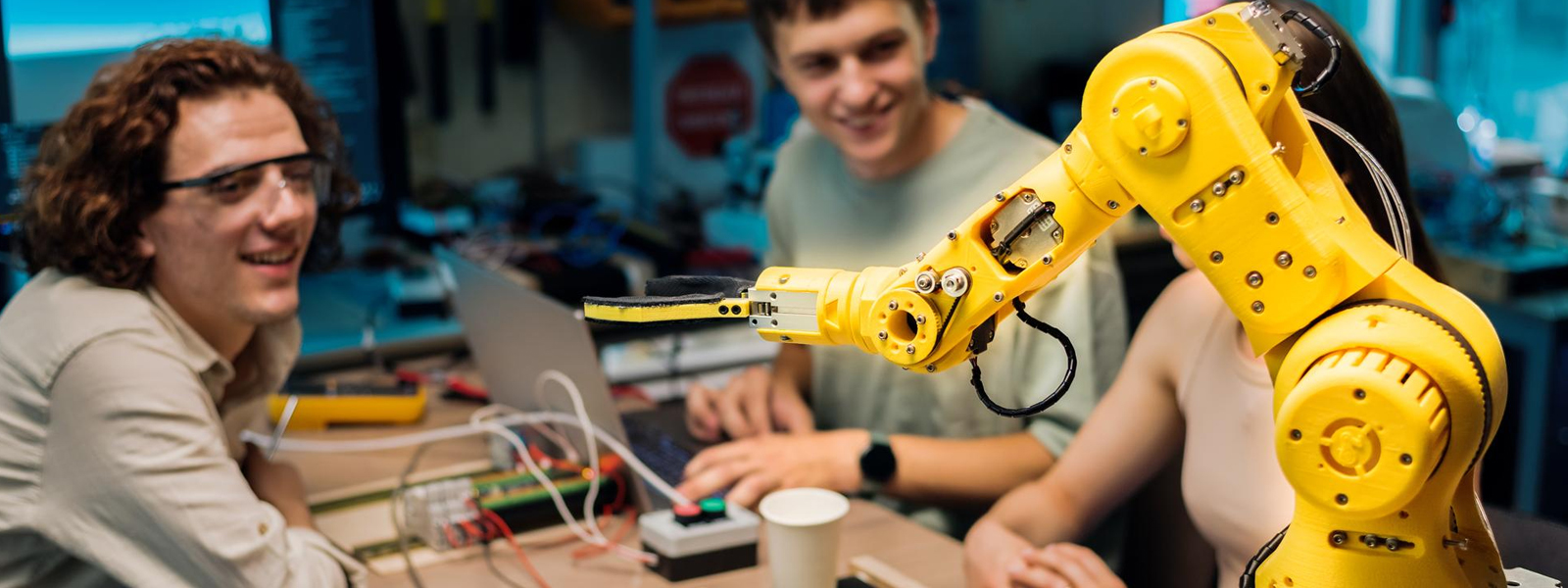

Collaborative robots, or cobots, are designed to work safely alongside human operators in shared workspaces. Unlike traditional industrial robots, cobots are equipped with advanced sensors, force-limiting technologies, and intuitive programming interfaces, enabling direct human-robot interaction without extensive safety barriers. Key technological components include:

- Actuators: Precision motors that facilitate smooth and responsive movements.

- Sensors: Proximity, force, and vision sensors that ensure safety and adaptability.

- Artificial Intelligence (AI): Machine learning algorithms that enhance decision-making and task execution.

- Power Systems: Energy-efficient modules that support prolonged operations.

Global Benchmarks and Market Dynamics

Since their commercial introduction in the mid-2000s, cobots have gained significant traction across various industries. As of 2023, cobots accounted for approximately 11% of all industrial robot installations worldwide, with annual sales nearing $3 billion and projected to grow over 30% annually. Prominent manufacturers include:

- Universal Robots: A Danish company recognized for pioneering user-friendly cobots.

- Fanuc: A Japanese firm offering a diverse range of robotic solutions.

- ABB: A Swiss multinational known for integrating AI into robotic systems.

- KUKA: A German company specializing in industrial automation.

These companies have developed cobots capable of performing tasks such as assembly, welding, packaging, and quality inspection, with payload capacities ranging from less than 5 kg to over 10 kg.

Market Size and Growth Projections

The global collaborative robot market is experiencing robust growth. In 2023, the market was valued at approximately $1.2 billion, with projections indicating an expansion to $6.8 billion by 2029, reflecting a Compound Annual Growth Rate (CAGR) of 34.3%.

1.2 China Snapshot

Market Position and Domestic Capabilities

China has emerged as a pivotal player in the cobot industry, driven by rapid industrialization and a strong emphasis on automation. The country accounted for over 50% of cobot installations in the Asia-Pacific region in 2023, underscoring its significant market share.

Domestic manufacturers have made substantial strides in developing core components, such as harmonic drives and precision sensors, reducing reliance on imports and enhancing the competitiveness of Chinese cobots.

Leading Firms and Product Deployments

Key Chinese companies in the cobot sector include:

- UBTECH Robotics: Known for humanoid robots and expanding into industrial cobots.

- Unitree Robotics: Specializes in quadruped robots with applications in logistics and inspection.

- Xiaomi: Diversifying into robotics with a focus on consumer and industrial applications.

These firms offer cobots at competitive price points, facilitating adoption across various sectors. Representative deployments encompass:

- Rehabilitation: Cobots assisting in physical therapy and patient care.

- Logistics: Automation of sorting, packing, and material handling processes.

National Policies and Industrial Targets

The Chinese government has implemented policies to bolster the robotics industry. The Ministry of Industry and Information Technology (MIIT) released the "Guiding Opinions on the Development of the Robot Industry" in 2023, setting ambitious targets for innovation, production, and application of robots, including cobots.

Cost-Performance Edge and Application Scaling

China's manufacturing ecosystem enables cost-effective production of cobots, offering a favorable cost- performance ratio. This advantage accelerates the scaling of cobot applications across industries, from automotive manufacturing to electronics assembly.

Role in Advancing "New Productive Forces"

Cobots are integral to China's strategy of fostering "new productive forces" (新质生产力), aligning with demographic shifts, industrial upgrading, and national goals such as smart factories, elder care, and logistics automation. Their deployment addresses labor shortages and enhances operational efficiency, contributing to the nation's economic transformation.

1.3 Strategic Significance and Use Cases

Global and China-Specific Market Estimates

The collaborative robot market is poised for substantial growth. Globally, the market is projected to reach $6.8 billion by 2029, with a CAGR of 34.3% from 2023 to 2029. In China, the market is expected to expand at a CAGR of approximately 30% over the next five years, driven by strong manufacturing and industrial automation adoption.

Growth Scenarios

Three potential growth scenarios for the cobot market include:

- High Growth: Rapid adoption driven by technological advancements and favorable policies.

- Medium Growth: Steady expansion with moderate adoption rates across industries.

- Low Growth: Slower uptake due to economic uncertainties or technological challenges.

Market Segmentation

The cobot market can be segmented by:

- Application Domain: Assembly, welding, packaging, quality inspection, and more.

- Customer Segment: Small and medium-sized enterprises (SMEs) and large corporations.

- Geography: North America, Europe, Asia-Pacific, and other regions.

Strategic Implications

The integration of cobots offers several strategic advantages:

- Enhanced Productivity: Automation of repetitive tasks leads to increased efficiency.

- Improved Safety: Cobots reduce workplace injuries by handling hazardous tasks.

- Flexibility: Easy reprogramming allows adaptation to various tasks and processes.

Use Cases

- Automotive Industry: Cobots assist in assembly lines, improving precision and speed.

- Electronics Manufacturing: Handling delicate components with high accuracy.

- Healthcare: Supporting surgical procedures and patient rehabilitation.

- Logistics: Automating sorting and packaging in warehouses.

In conclusion, collaborative robots represent a transformative force in the robotics industry, offering versatile solutions that enhance productivity, safety, and flexibility across diverse sectors. Their continued development and adoption are set to play a pivotal role in the future of industrial automation.

AGP Insights

Download PDF.

Your PDF report was sent successfully to your inbox!

Related Insights.