China’s SaaS AI Playbook: Lessons for Multinational Innovators

As the world races to harness artificial intelligence, China is reshaping the terms of engagement. Nowhere is this more evident than in the country’s fast-growing enterprise AI sector, where a new breed of SaaS innovators is doing what global players often struggle to achieve: delivering useful AI at scale, at speed, and at a cost that outpaces traditional models.

For multinational executives overseeing global R&D, innovation strategy, or digital transformation, the question is what can be learned from China’s model, and how quickly those lessons can be applied beyond its borders.

From Platform Ambitions to Applied Intelligence

International technology firms in the US and Europe have largely pursued AI from the top down, building expansive platforms designed to transform entire functions—marketing automation, predictive maintenance, end-to-end supply chains. This “horizontal-first” approach, while conceptually elegant, has often resulted in long sales cycles, ambiguous ROI, and underutilized software.

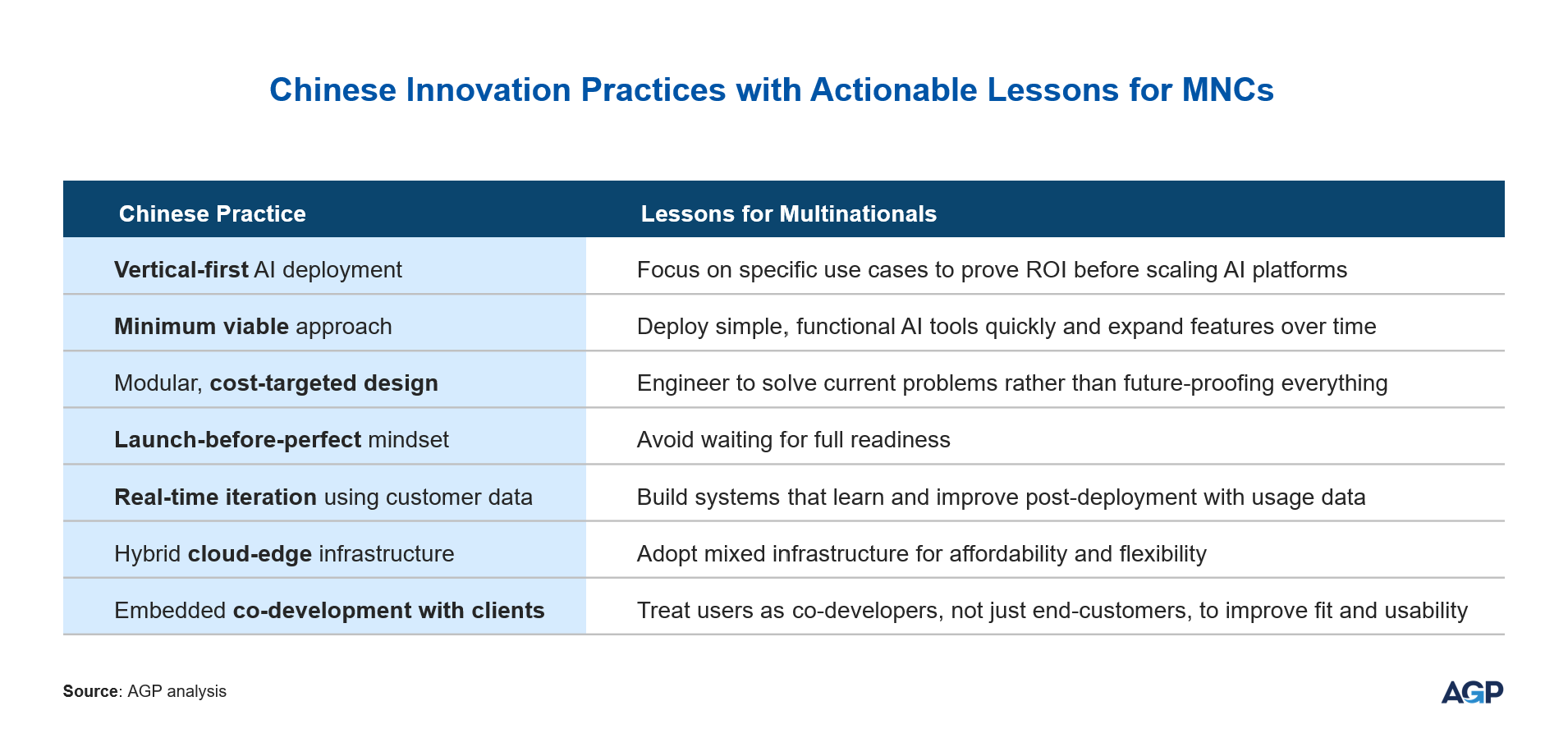

In contrast, China’s AI SaaS companies have pursued a bottom-up, vertical-first strategy. Rather than building broad, abstract capabilities, they focus obsessively on narrow, high-impact use cases. The model is clear: solve a specific pain point well, demonstrate rapid ROI, and expand incrementally.

Take 4Paradigm, a Chinees pioneer firm in automated machine learning (AutoML) platforms. While competitors in the US and Europe debated how to standardize ML workflows, 4Paradigm worked closely with Chinese banks to co-develop fraud detection engines, credit risk scoring models, and dynamic pricing tools—all tailored to local regulatory and data realities.

The results spoke for themselves: fast adoption, sticky customer relationships, and an eventual evolution into a scalable platform.

This pragmatic, ground-up strategy reflects a broader cultural trait in Chinese B2B tech: focus on execution over architecture, outcomes over elegance.

Innovation at China Speed

Perhaps the most defining feature of China’s enterprise AI sector is the tempo at which innovation happens. In most Western organizations, AI rollouts are methodical: road mapped, piloted, evaluated, refined, then scaled. In China, the cadence is far less linear: test in-market, fix in deployment, improve with every use.

What this looks like in practice is closer to agile industrialization than traditional software development. A company like iFlytek, China’s leading voice AI and speech recognition provider, exemplifies this operational philosophy. Widely used in sectors ranging from healthcare and education to law enforcement and public administration, iFlytek's products don’t undergo the kind of protracted testing and certification cycles typical of their Western counterparts. Instead, the company adheres to a “deploy-and-adapt” model.

Take, for example, its AI transcription systems used in courtrooms across China. These systems were rolled out while still imperfect, struggling initially with dialects, legal jargon, and courtroom noise. But rather than delaying deployment for years of offline training and user acceptance testing, iFlytek launched early and fed real-world usage data back into its learning loop. Court reporters and judges provided feedback on accuracy and relevance, which the system used to improve itself iteratively and sometimes updating speech models weekly.

Similarly, in the healthcare domain, iFlytek’s diagnostic assistants began with limited scope: offering symptom-based suggestions rather than definitive diagnoses. As doctors used the system, new insights, terminology, and region-specific patterns were incorporated into the AI models. What began as a narrow tool to support overworked clinicians evolved into a broader decision-support engine integrated with hospital IT systems, medical imaging, and electronic records.

This mode of innovation, sometimes described internally as "data-fueled co-evolution", allowed iFlytek to iterate in real time. It also reflects a cultural willingness to embrace imperfection if it enables learning.

Chinese enterprise AI firms frequently adopt what can be described as a minimum viable intelligence approach: launch with the smallest functional model that can generate business value, then scale its complexity with usage.

In a healthcare pilot, for instance, Pares AI, a Chinese medical imaging company, exemplifies this approach. Rather than waiting to develop a full diagnostic engine, it launched with a lightweight anomaly detection model that helped radiologists triage scans faster, reducing their workload by 30%, and then expanded its feature set as user feedback accumulated.

Redefining Cost-to-Value in Enterprise Software

Another striking contrast lies in the economics of enterprise AI. Chinese SaaS firms typically operate with much leaner cost structures, not because they cut corners, but because they have mastered the art of modular engineering and cost-targeted design.

Where Western vendors often overbuild software to future-proof it, Chinese firms build just enough software to solve the current problem. This focus on “good enough now” yields significant advantages:

- Lower total cost of ownership (TCO) for customers.

- Shorter deployment timelines, often measured in weeks not quarters.

- More accessible entry points, especially in mid-sized enterprises or Tier 2–3 cities.

A case in point is Pares AI, already mentioned above. Rather than selling a full AI suite requiring major hospital IT investment, Pares provides lightweight tools that run on existing infrastructure, combining cloud inference for complex cases with edge deployment for routine scans. This hybrid model ensures both performance and affordability, widening the addressable market.

The implication for multinational firms is profound. In many industries, the future may not belong to the most powerful platform—but to the most deployable, affordable, and iteratively improving one.

What Quality Means in the Chinese Context

For years, Chinese tech was characterized as fast and cheap but lacking in reliability or sophistication. Such a narrative is rapidly losing relevance. Today’s leading Chinese SaaS firms are not sacrificing quality; they are redefining how it is achieved.

Traditional enterprise software quality is rooted in completeness—stable releases, extensive documentation, cross-functional compatibility. In China, quality is increasingly a function of usage data and continuous refinement. The more the product is used, the better it becomes.

Moreover, AI quality is no longer solely about model accuracy. It’s about explainability, relevance, and user fit. Chinese developers are becoming adept at building context-aware AI, informed by unique local data advantages: language diversity, consumer behavior scale, and government openness to AI-driven efficiency in public services.

What’s emerging is a dynamic view of quality: less about getting it “right” in the lab, and more about getting it “real” in the field.

What Multinationals Must Rethink

China’s enterprise AI trajectory is both a challenge and an invitation—challenging the traditional pace, economics, and design philosophy of enterprise tech in the US and Europe. And it invites global companies to rethink how they innovate—with China not only as a market but as a model.

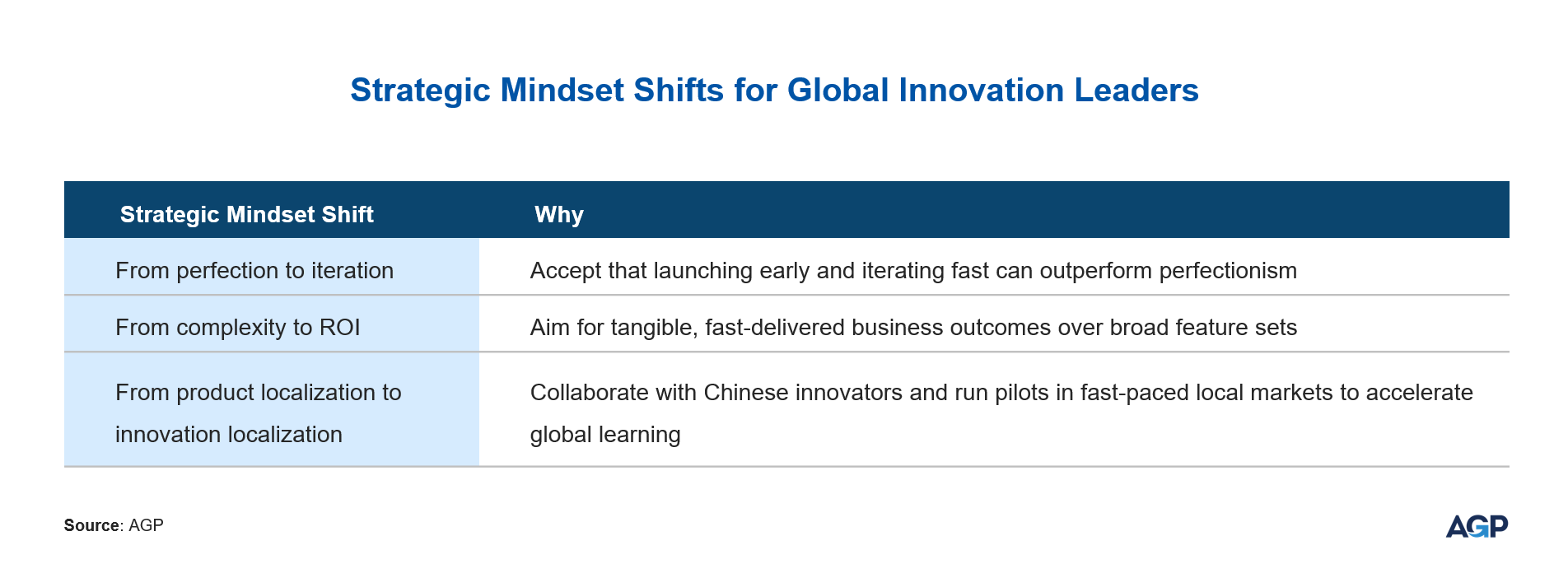

Here are three key mindset shifts multinational innovation leaders must consider:

1. Move from perfection to iteration.

Perfection is not only expensive; it’s slow. By the time a “perfect” solution is deployed, the market may have moved on. Adopt a culture of iterative AI deployment: release small, learn fast, evolve continuously.

2. Build for ROI, not complexity.

Too many AI projects fail because they aim to do too much too soon. China’s AI firms start with constrained goals and achieve impact quickly. Focus on business outcomes, not technology sophistication.

3. Localize innovation, not just products.

Many MNCs localize their products for China, but not their innovation processes. There’s an opportunity to co-innovate with local firms, pilot ideas in China’s fast-moving market, and bring learnings back to global operations.

The Geopolitical Lens: Innovation Amid Decoupling

Of course, no discussion of China’s tech sector is complete without acknowledging the geopolitical backdrop.

Growing scrutiny of data flows, cybersecurity standards, and tech sovereignty have made collaboration more complex. Yet paradoxically, this environment has also sharpened China's focus on domestic innovation self-reliance, especially in AI, semiconductors, and enterprise software.

For multinational firms, this doesn’t mean disengagement. It means being smarter about partnership models, IP frameworks, and local R&D footprint strategies. It also means recognizing that studying how Chinese companies build, not just what they build, can yield powerful competitive insights, even without direct technology transfer.

Closing Thoughts: The New Innovation Benchmark

In a world where AI is becoming table stakes, how you build matters as much as what you build. China’s AI SaaS firms are not ahead in every dimension, but they are setting a new benchmark in speed, scale, and pragmatism. Their advantage lies not just in algorithms or data, but in a systems approach to enterprise innovation.

For global firms that want to compete in the age of AI, the real risk isn’t being outcoded. It’s being out-learned. And right now, the fastest learners are moving at China speed.

Related Insights.