Parallel Innovation: China’s Edge in Biopharma

Over the past decade, China has rapidly emerged as a powerhouse in pharmaceutical innovation. What began as a generics-driven, cost-sensitive market has evolved into a high-speed innovation engine capable of producing cutting-edge therapies—often faster and at a fraction of the cost seen in the West.

Behind this transformation lies a distinct operational strategy: parallel processing across the drug development lifecycle. Unlike the traditional linear model followed by most multinational companies (MNCs), Chinese biopharma firms have institutionalized an approach that accelerates time-to-market by running clinical trials, regulatory submissions, manufacturing scale-up, and digital integration concurrently rather than sequentially.

This Insight explores how Chinese pharmaceutical companies are running processes in parallel, what makes this system unique compared to global norms, and what MNCs can learn from the China model.

What Is Parallel Processing in Pharma?

In most mature pharmaceutical markets, development stages proceed cautiously one after the other—discovery, preclinical, Phase I, II, III trials, regulatory review, and finally manufacturing scale-up. This structure minimizes risk but also stretches timelines and drives up costs.

Chinese companies, in contrast, operate with a “default parallelization” mindset, pursuing overlapping stages where possible. This strategy allows for compression of timelines, higher resource utilization, and ultimately faster commercialization—without compromising quality or compliance.

Key Drivers Behind China's Parallel Advantage

1. Regulatory Innovations Enable Early Start

China's National Medical Products Administration (NMPA) has implemented significant regulatory reforms to expedite the initiation of clinical trials. A pivotal change was the adoption of the "implied license" policy for Investigational New Drug (IND) applications in 2018. Under this system, if the NMPA does not raise any objections within 60 working days of receiving a complete clinical trial application, the sponsor is permitted to commence the trial. This approach effectively reduces the waiting period that was previously required for explicit approval, thereby accelerating the transition from application to trial initiation.

Furthermore, the NMPA has introduced pilot programs aimed at further reducing review timelines. For instance, a 2024 initiative seeks to shorten the clinical trial application review period to 30 working days for innovative drugs, reflecting China's commitment to fostering a more agile and responsive regulatory environment.

2. Overlap of Trial Phases

China's entry into the International Council for Harmonisation of Technical Requirements for Pharmaceuticals for Human Use (ICH) in 2017, through the NMPA, marked a turning point.

This alignment with global standards—especially ICH E5, E6, and E17—enabled the acceptance of overseas clinical data and participation in simultaneous multi-regional clinical trials (MRCTs), provided the data meet scientific and ethical standards.

This regulatory shift made it possible for companies to run overlapping clinical phases, rather than waiting for one phase to conclude before initiating the next. Programs now advance based on rolling safety data, significantly reducing time to global filings and commercial readiness.

Companies like BeiGene have pioneered simultaneous Phase I–III trials across China, the U.S., and Australia for drugs like Brukinsa (zanubrutinib), significantly accelerating time to global approval. In 2021, BeiGene partnered with Novartis to co-develop and commercialize Brukinsa outside China. The deal combined BeiGene’s rapid development capability and trial infrastructure with Novartis’s global commercial reach.

Similarly, Henlius Biotech is conducting parallel Phase III trials for its anti-PD-1 therapy Serplulimab across China and Australia, streamlining global development and regulatory readiness through synchronized multi-regional trial execution.

3. Integrated CRO–CDMO Ecosystem

China's pharmaceutical innovation is significantly propelled by a robust and integrated Contract Research Organization (CRO) and Contract Development and Manufacturing Organization (CDMO) infrastructure.

Leading entities like WuXi AppTec and WuXi XDC have established comprehensive platforms that facilitate seamless transitions from drug discovery through clinical development to commercial manufacturing. This integration enables parallel processing of various development stages, thereby accelerating time-to-market for new therapies.

WuXi AppTec, through its subsidiary WuXi STA, offers a fully integrated platform for small molecule drug development that spans the entire value chain—from early discovery and preclinical research to clinical trials and commercial manufacturing. This includes services in medicinal chemistry, pharmacology, toxicology, regulatory support, and large-scale production of both APIs and finished dosage forms. By consolidating these capabilities, WuXi enables companies to conduct clinical development and manufacturing activities in parallel, significantly reducing timelines and improving efficiency.

WuXi XDC, a joint venture between WuXi Biologics and WuXi STA, provides end-to-end development and manufacturing services for bioconjugates such as antibody-drug conjugates (ADCs). Its integrated offering spans conjugation process development, GMP manufacturing of intermediates and final products, and regulatory support. This consolidation enables clients to accelerate and simplify the complex development pathway for bioconjugate therapies.

4. Government-Backed Industrial Support

China's biotech innovation is significantly propelled by its government-backed industrial support, particularly through the development of specialized biotech hubs such as Zhangjiang Hi-Tech Park in Shanghai and Zhongguancun Science Park in Beijing. These hubs are designed to foster innovation by providing comprehensive support that goes beyond mere physical infrastructure.

These government-backed hubs exemplify China's strategic approach to fostering biotech innovation:

- Co-location of Functions: By integrating R&D, regulatory, and manufacturing functions within the same geographic area, these parks minimize communication delays and enhance efficiency.

- Public-Private Partnerships: Collaboration between government entities and private firms accelerates the commercialization of research findings.

- Building Resilience: The concentration of resources and expertise within these hubs strengthens China's self-reliance in critical technologies and reduces dependence on foreign entities.

5. AI Integration from Discovery to Development

Chinese biotech companies are at the forefront of integrating artificial intelligence (AI) across the entire drug development pipeline, from initial discovery to clinical trial design. This comprehensive application of AI is significantly reducing development timelines and costs, positioning China as a leader in AI-driven pharmaceutical innovation.

XtalPi combines AI, quantum physics, and cloud computing to enhance drug discovery and development processes. Their Integrated Digital Drug Discovery and Development (ID4) platform offers end-to-end solutions, including target identification, lead optimization, and preclinical candidate selection. By simulating molecular interactions and predicting compound properties, XtalPi enables rapid identification of viable drug candidates, streamlining the path to clinical trials

Insilico Medicine employs a suite of AI platforms —PandaOmics for target discovery, Chemistry42 for molecule generation, and InClinico for clinical trial prediction— to facilitate the entire drug development process. Notably, in 2021 Insilico advanced a novel anti-fibrotic drug candidate from discovery to Phase I clinical trials in under 30 months, demonstrating the efficiency of their AI-driven approach. Its platforms also assist in predicting clinical trial outcomes, aiding in the design of more effective and efficient studies.

6. Digital Trials and Smart Recruitment

Chinese biopharmaceutical companies are increasingly leveraging digital technologies to enhance clinical trial efficiency. Innovent Biologics, for instance, has adopted digital platforms to streamline patient recruitment, trial monitoring, and adaptive trial designs. By utilizing electronic health records and AI-driven analytics, these platforms facilitate the identification of suitable trial participants and enable real-time data monitoring, allowing for timely adjustments to trial protocols.

Such digital integration not only accelerates the recruitment process but also enhances the overall agility and responsiveness of clinical trials, positioning companies like Innovent at the forefront of innovative drug development in China.

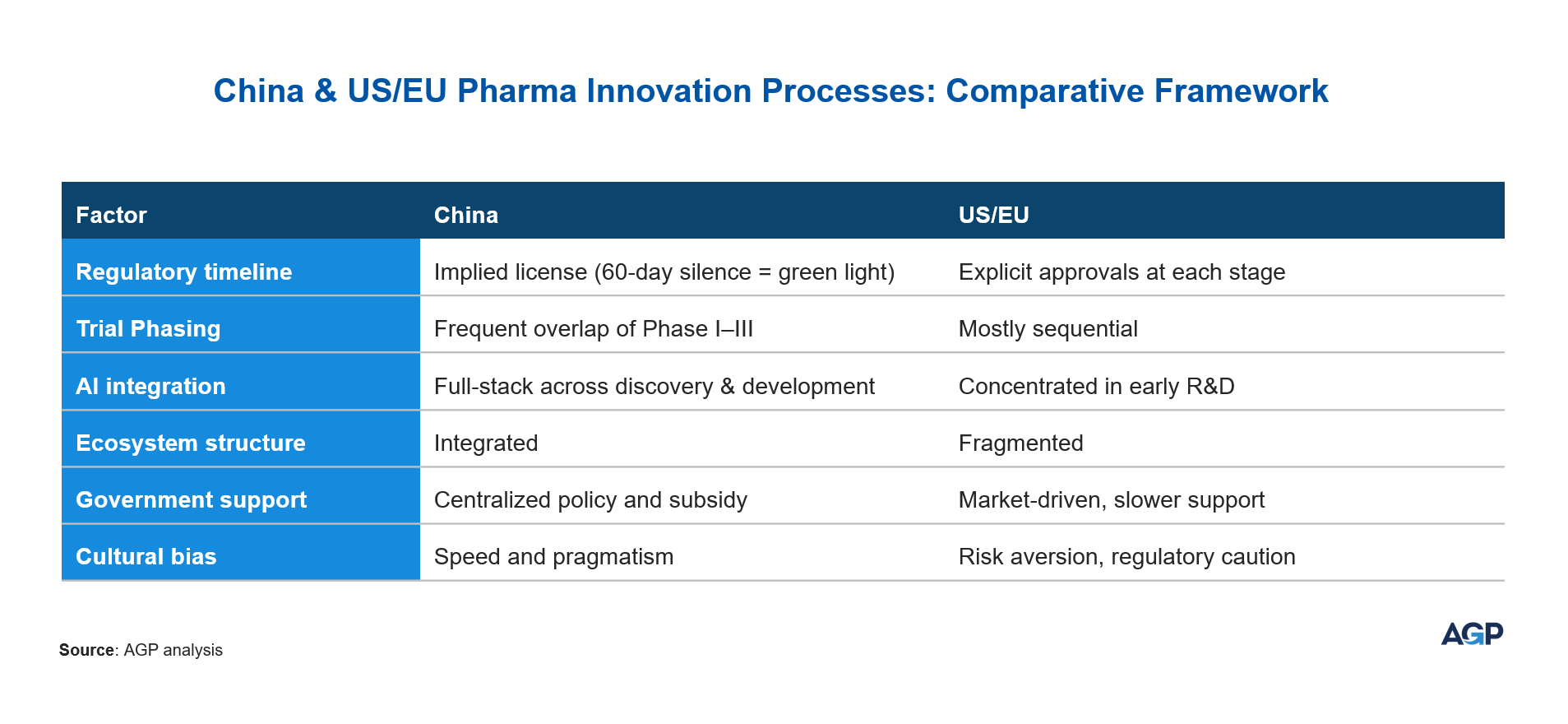

Is This Truly Unique to China?

Parallel processes are not unheard of in the U.S. or Europe, especially in high-priority fields like oncology. However, in these markets, parallelization is less common and is typically reserved for high-priority or accelerated programs. The Chinese model is more institutionalized, with regulatory, organizational, and cultural factors supporting speed and integration.

In Western markets the ecosystem tends to be fragmented, with separate CROs, CDMOs, and regulatory advisors, which slows down synchronization. Moreover, regulatory gatekeeping is more rigid, and companies are more risk-averse.

In contrast, China’s model features:

- Institutionalized speed: Implied approval and fast-track designations.

- Vertical integration: CRO, CDMO, AI, and manufacturing are often co-located or under the same group.

- Cultural mindset: A national focus on speed as a competitive advantage — “China speed.”

What Can Multinationals Learn?

Pharma and biotech companies operating in or with China can adapt elements of this model:

Make Parallel Development the Default, Not the Exception

Chinese firms normalize the concurrent execution of discovery, trials, regulatory, and manufacturing activities. MNCs should assess how to responsibly overlap phases, especially with the support of reliable safety signals, to compress timelines and reduce opportunity costs.

Integrate Functions Across the Value Chain

Working with CROs and CDMOs that offer end-to-end services enables seamless handoffs and minimizes friction between stages. Co-locating R&D, regulatory, and manufacturing, as seen in Zhangjiang and Zhongguancun, also improves communication speed and execution efficiency.

Use AI Beyond Discovery

MNCs should explore how to integrate AI across later-stage development and trial optimization, not just molecule screening. AI in China is not limited to early-stage drug design. Companies like Insilico Medicine apply AI throughout preclinical modeling, toxicity prediction, and even clinical trial design.

Leverage Digital Trials for Speed and Flexibility

Chinese companies like Innovent Biologics are using digital platforms to enhance patient recruitment, enable adaptive trial designs, and make data-driven decisions in real time. MNCs can adopt similar tools to accelerate recruitment and manage multicenter trials more effectively, especially in Asia.

Co-Innovate and Localize

Companies like BeiGene have shown the power of combining Chinese execution speed with global commercialization partnerships. MNCs should consider co-developing or licensing innovative assets from Chinese biotech firms to expand their pipeline while staying agile in local markets.

See China as a Launch Market

With world-class talent, infrastructure, and a supportive regulatory environment, China is now a viable market for first launches of innovative therapies, not just for scale-up or cost reduction.

Final Thoughts

The parallel development model embraced by Chinese pharma is a strategic rethinking of how innovation can scale. With global biopharma facing rising costs, increasing regulatory scrutiny, and pressure to deliver faster, the China model offers a competitive blueprint.

As regulatory harmonization increases (e.g., via ICH guidelines), more MNCs may find themselves adopting China’s parallel playbook.

Related Insights.