The Global Expansion of Chinese Multinational Corporations

For decades, China has been the world’s factory, churning out products that have reached every corner of the globe. Today Chinese companies are no longer just producing for foreign brands—they are competing head-to-head on the global stage. From electric vehicles to artificial intelligence, China’s multinational corporations (MNCs), are expanding rapidly, backed by government initiatives, financial muscle, and cutting-edge technology.

Yet, this international push comes with challenges. Stricter regulations in Europe and North America, brand trust issues, and geopolitical headwinds are testing the resilience of these firms. Can Chinese companies adapt, localize, and thrive in foreign markets, or will they struggle to replicate their domestic success abroad?

This Insight piece explores why Chinese companies are going global, where they are investing, how they are funding their expansion, and the critical obstacles they must overcome.

What’s Driving Chinese Companies to Go Global?

Several macroeconomic and business conditions have influenced the outward push of Chinese firms:

- Slowing Domestic Growth: After decades of rapid economic expansion, China’s growth rate has moderated. The rapid economic boom from past decades has transitioned to a more moderate pace across various industries, prompting companies to look beyond domestic markets for expansion. Companies such as Haier, which acquired GE Appliances in 2016 to strengthen its presence in the U.S. market, and NIO, which expanded into the European EV market in 2021 through a direct sales model, exemplify this strategic shift.

- Technological Maturity: Many Chinese enterprises have developed advanced capabilities in fields such as telecommunications, consumer electronics, and artificial intelligence. Huawei and Xiaomi have become dominant global players in the smartphone industry, while BYD and CATL are spearheading China’s dominance in electric vehicles (EVs) and battery technology.

- Financial Diversification and Risk Mitigation: Expanding beyond China allows firms to manage financial risks associated with regulatory changes, currency fluctuations, and supply chain disruptions. Alibaba’s investments in Southeast Asia, particularly through Lazada, illustrate efforts to mitigate risks by diversifying revenue streams.

- Government Policy and Trade Dynamics: The Belt and Road Initiative (BRI) and other state-backed programs have facilitated outbound investment. The China Development Bank has played a significant role in funding large infrastructure projects in Africa and Asia, supporting Chinese firms such as State Grid and China Railway Construction Corporation.

Chinese Companies and Global Brand Recognition

Despite China’s economic influence, its global brand penetration remains limited. According to the 2024 Interbrand Global Brand Ranking, only two Chinese brands made it into the top 100 global brands: Xiaomi, at the 87th position, and Huawei, at the 93rd position. This underrepresentation underscores the challenges Chinese firms face in establishing strong international brand identities, particularly in Western markets where consumer trust and familiarity are crucial.

In contrast, companies from the U.S., South Korea, Japan, and several European nations dominate global brand rankings. Samsung, Toyota, and Apple have built global recognition over decades, while Chinese firms are still in the early stages of gaining widespread international trust.

Key Markets for Chinese Multinational Companies

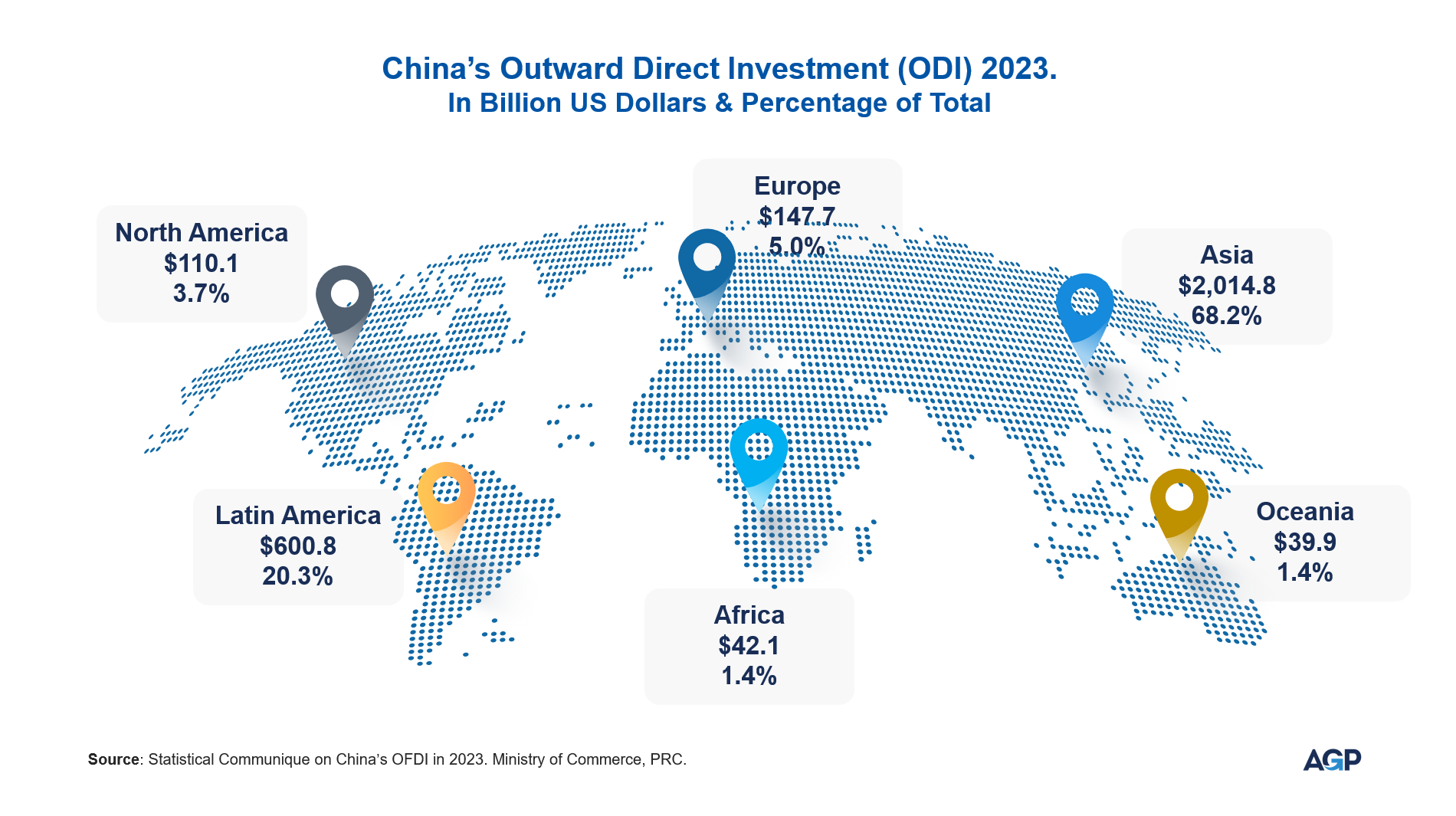

Asia: China’s Outward Direct Investment (ODI) in Asia amounted to US $2,014.8 billion, with 87% of that investment concentrated in Hong Kong. ASEAN has continued to rise, with direct investment reaching $25.12 billion in 2023, according to China's Ministry of Commerce. This growth is driven by both shifting supply chains and increasing trade integration. Manufacturing firms such as BYD and Foxconn are expanding their production bases in Vietnam and Thailand to circumvent tariffs and supply chain disruptions. In addition, companies like CATL, the battery giant, have invested heavily in Indonesia’s nickel industry to secure raw materials for EV production, while Alibaba’s logistics arm, Cainiao, has expanded its Southeast Asia footprint through regional hubs in Malaysia and Singapore.

Europe: While Europe remains an attractive market due to its industrial base and technological strengths, investment has declined due to heightened regulatory scrutiny. According to China's Ministry of Commerce, China's ODI Europe stood at US $147.7 billion in 2023 – 5% of China’s total ODI –, a decrease from previous years due to tightened foreign investment screening mechanisms.

Companies like Tencent and TikTok parent company ByteDance have encountered regulatory pushback on data privacy issues. However, other firms such as Geely, which has expanded its electric vehicle operations through its ownership of Volvo and Polestar, and CATL, which has launched a battery production facility in Germany, are deepening their European presence despite regulatory headwinds.

North America: According to the latest data from the Chinese Ministry of Commerce, ODI in North America fell to US $110.1 billion (3.7 percent) in 2023, reflecting ongoing geopolitical tensions and heightened scrutiny of Chinese investments in strategic sectors.

Chinese firms continue to navigate complex regulatory environments in the U.S. and Canada, facing barriers such as tariffs and security-related restrictions on acquisitions. The current administration's latest round of tariff implementations in early 2025 has further strained trade relations, particularly targeting high-tech sectors and electric vehicle supply chains.

Middle East and Africa: China's ODI in the Middle East and Africa reached US $39.9 billion in 2023, reflecting growing engagement in sectors like renewable energy and logistics. China’s investments in Africa, particularly in infrastructure and telecommunications, have positioned it as a dominant player in these markets. In addition to Sinopec and Huawei, companies such as China National Offshore Oil Corporation (CNOOC) have made significant investments in offshore drilling in Nigeria, while Alibaba’s Ant Group has expanded mobile payment solutions across key African markets. Furthermore, Chinese automaker Chery has increased manufacturing operations in Egypt, targeting the growing demand for electric and fuel-efficient vehicles.

How Chinese Companies Fund Their International Growth

Chinese firms utilize multiple financing strategies to support their global expansion:

- State-Backed Financial Institutions: Institutions such as the China Development Bank and the Export-Import Bank of China provide loans and financial support for overseas ventures, particularly in infrastructure and energy projects. For instance, in December 2023, the China Development Bank provided a $2 billion loan to CATL to support its battery manufacturing expansion in Germany. Similarly, in November 2023, the Export-Import Bank of China extended a $1.5 billion credit line to Huawei for 5G infrastructure projects in Africa, aiding its network expansion across multiple countries. These financial backings have been crucial in allowing Chinese firms to strengthen their global footprint despite increasing regulatory challenges.

- Equity and M&A: While mergers and acquisitions (M&A) were historically a dominant strategy, greenfield investments (building operations from scratch) and international collaborations are now taking precedence due to regulatory challenges associated with acquiring foreign firms. For example, Geely has increasingly opted for international collaborations, such as its expansion of Polestar in global markets and its strategic cooperation with Renault for hybrid powertrain development, to form the HORSE Powertrain Ltd. joint venture.

- Corporate Bonds and IPOs: Many Chinese firms leverage international capital markets, issuing bonds or listing on foreign stock exchanges to raise funds for overseas expansion. Alibaba was listed on the New York Stock Exchange in September 2014, raising US $25 billion; JD.com raised almost US $4.46 billion after making its Hong Kong Stock Exchange debut on June 18, 2020.

ESG Regulations and Compliance Challenges

As Chinese firms expand internationally, they must navigate increasingly stringent Environmental, Social, and Governance (ESG) regulations, particularly in Europe and North America.

The EU has introduced multiple ESG frameworks, notably the Corporate Sustainability Reporting Directive (CSRD) and the Carbon Border Adjustment Mechanism (CBAM), which require foreign firms, including Chinese multinationals, to meet sustainability and transparency standards. For instance, CATL's battery plant in Germany has had to integrate ESG compliance measures to meet EU carbon footprint standards, and the company confirmed that it would pursue carbon neutrality beyond the requirements of any region, in anticipation of Europe’s battery carbon footprint benchmarks. Alibaba has adjusted its logistics operations to align with Europe's circular economy regulations, by investing in greener packaging, recycling, and waste reduction.

In the U.S., the Securities and Exchange Commission (SEC) heightened, in March 2024, climate disclosure requirements – such as greenhouse gas emissions and climate risks – on listed companies, impacting Chinese firms trading on U.S. exchanges. Additionally, Chinese companies involved in high-emission industries, such as steel and EV production, are under increasing scrutiny regarding their global carbon impact. So far, this regulatory shift has pushed firms like BYD and Sinopec to revise their sustainability strategies to maintain market access and investor confidence. As of February 2025, Acting SEC Chair Mark Uyeda announced a directive to halt the defense of the climate disclosure rules, a move suggesting a shift towards revising or potentially rescinding the existing climate-related disclosure requirements.

China’s investments in Africa have also faced ESG-related concerns, with international institutions - including local regulators and development partners - emphasizing the need for stronger environmental and labor standards in Chinese-led infrastructure projects. In the energy sector, for example, Chinese oil companies investing in East Africa have come under scrutiny to minimize ecological and social harms. Uganda’s government and international observers have insisted that the planned oil developments (jointly led by TotalEnergies and China’s CNOOC) adhere to strict ESG safeguards. On the labor side, technology firms have also been impacted – a prominent case is Huawei in South Africa. Huawei’s African operations have faced scrutiny under local labor and equity laws, which align with global social governance norms.

Challenges of Global Expansion: When Chinese Strengths Become Weaknesses

While Chinese firms have demonstrated remarkable success in their domestic market, many of the strategies that propelled their growth do not always yield the same results internationally:

- Speed vs. Precision: Chinese firms often prioritize swift executions when looking for market opportunities rather than extensive due diligence. According to research by McKinsey & Co., cross-border M&A deals by Chinese buyers have performed worse over time: in the period 2008-2012, most deals (74% by transaction volume and 90% by transaction value) outperformed the market after 3 years; In 2013-2017, the success rate dropped, with only 64% by transaction volume and 74% by transaction value outperforming the market.

- Talent Mobilization: The ability to rapidly deploy human capital within China does not easily translate to global operations, where local expertise, cultural adaptability, and labor regulations differ significantly. For example, in 2023, Huawei reorganized its European operations by decentralizing decision-making and appointing regional executives in Germany and France to navigate stricter regulatory environments. Similarly, Alibaba restructured its Southeast Asia operations in late 2023, focusing on localized leadership in Indonesia and Malaysia to better adapt to evolving e-commerce regulations and competition.

- Top-Down Decision-Making: While hierarchical decision-making structures work well in China’s centralized corporate culture, Western markets often require more collaborative, decentralized management styles. In 2023, ByteDance established localized management teams in Europe and Southeast Asia, allowing greater autonomy in decision-making to align with regional regulatory environments.

Final Considerations

The global expansion of Chinese MNCs has been fueled by a combination of economic pressures, policy initiatives, and technological advancements. While China’s domestic market remains a powerhouse, companies are increasingly looking abroad to sustain growth, mitigate financial risks, and establish global brand recognition.

While Chinese MNCs are making significant inroads into global markets, their long-term success will depend on their ability to adapt to regulatory environments, invest in brand building, and refine their international operational strategies.

The growing complexity of global trade, geopolitical tensions, and ESG compliance requirements will test the resilience of these firms. However, those that embrace localization, compliance, and strategic partnerships will likely emerge as strong competitors on the world stage.

Related Insights.