AGP China Technology Report - Retail Robots

Table of Contents

Page Section

03 Technology Overview

06 Historical Development Timeline

09 Product Differentiation

13 China Technology Ecosystem

16 Sino-Foreign Collaboration

19 Common Applications In China

26 Government Policy Support

29 Impact On Market Incumbents

31 Final Conclusion

32 Appendices

1.1 Global Snapshot

Definition and Scope

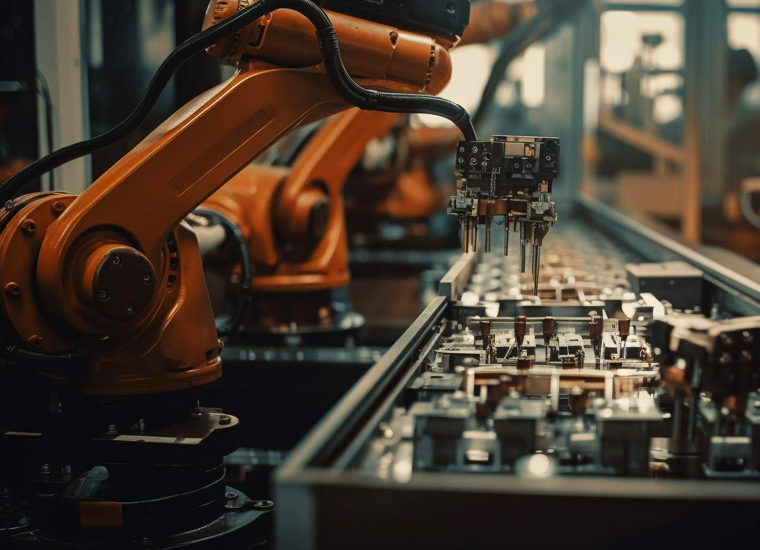

Retail robots are autonomous or semi-autonomous machines designed to enhance retail operations through tasks such as inventory management, customer service, cleaning, and security. They are largely categorized into:

- Mobile Robots: Navigate store environments for tasks like shelf scanning and stock management.

- Stationary Robots: Perform fixed-location tasks such as checkout assistance.

- Autonomous Mobile Robots (AMRs): Capable of navigating independently within dynamic retail settings.

Key Technologies

The core technologies driving retail robotics include:

- Sensors and Actuators: Essential for movement and environmental interaction.

- Artificial Intelligence (AI): Powers decision-making and enhances customer interaction capabilities.

- Computer Vision: Utilized for product recognition and inventory tracking.

- Cloud Connectivity: Facilitates data processing and real-time updates.

Global Benchmarks

Some notable global examples include:

- Simbe Robotics' Tally: An autonomous shelf-scanning robot used in major retail chains.

- SoftBank Robotics' Pepper: Engages customers and provides assistance in retail environments.

Market Size and Growth

- The global retail robotics market was valued at approximately USD 21.93 billion in 2023, with projections reaching USD 229.12 billion by 2032, at a CAGR of 34.20%.

- The market is expected to grow from USD 18.23 billion in 2023 to USD 88.27 billion by 2028, with a CAGR of 37.2%.

Key Performance Indicators (KPIs)

- Degrees of Freedom (DOF): Impacts the robot's range of motion.

- Operational Runtime: Duration of robot operation before recharging is needed.

- Payload Capacity: Maximum weight a robot can handle, critical for restocking tasks.

1.2 China Snapshot

Market Position and Domestic Capabilities

China is a significant player in the retail robotics sector:

- Market Share: Asia Pacific, including China, is a rapidly growing market for retail robots.

- Core Components: Chinese firms have developed capabilities in producing key components like sensors and actuators.

Leading Firms and Deployments

Key Chinese companies in the retail robotics field include:

- UBTECH Robotics: Known for humanoid robots in retail settings.

- Unitree Robotics: Specializes in adaptable quadruped robots for retail.

Product Pricing and Applications

- Chinese retail robots are priced competitively, providing cost-effective solutions.

- Applications include inventory management and customer engagement within retail stores.

National Policies and Industrial Targets

- MIIT 2023 “Guiding Opinions”: Aims to accelerate intelligent robot development.

- Industrial Targets: Focus on increasing domestic robot production.

Cost-Performance Edge and Application Scaling

- Chinese robots offer a favorable cost-performance ratio, facilitating widespread adoption.

- Scalability allows deployment in various retail formats, from small shops to large chains.

Advancing “New Productive Forces”

Retail robots contribute to new productive forces by:

- Improving Efficiency: Automating routine tasks.

- Encouraging Innovation: Integrating advanced tech into traditional retail.

Link to Demographic Shifts and National Goals

- Demographic Shifts: Address labor shortages with automation.

- National Goals: Align with industrial modernization and smart manufacturing goals.

Policy Relevance and Tech-Industry Integration

- Government initiatives support retail robotics adoption.

- Collaborations between tech firms and retailers enhance integration.

1.3 Market Size

Global and China-Specific Market Estimates

- The global retail robotics market is projected to grow significantly, with forecasts estimating values reaching USD 77.13 billion by 2028.

- Asia Pacific, including China, is expected to be the fastest-growing market.

Growth Scenarios

- High Growth: Driven by tech advancements and policy support.

- Medium Growth: Steady integration and moderate investment.

- Low Growth: Slower uptake due to costs and complexities.

5-Year CAGR Estimates

- Estimates range from 28.73% to 37.2%, influenced by factors like adoption speed and regulatory support.

Market Breakdown

- By Application Domain:

- Inventory Management: Leading due to efficient stock control needs.

- Delivery Management: Fast-growing with demand for contactless solutions.

- By Customer Segment:

- Supermarkets and Hypermarkets: Major adopters of retail robots.

- E-commerce Warehouses: Utilize robots for logistics and fulfillment.

- By Geography:

- North America: Leading market with advanced infrastructure.

- Asia Pacific: Fastest-growing, especially in China and Japan.

AGP Insights

Download PDF.

Your PDF report was sent successfully to your inbox!

Related Insights.