The Dragon's Roar: China's AI Titans Shape a New Era

In the relentless race toward AI supremacy, China emerges as the second-largest AI economy globally. This ascent is not accidental; it's powered by unwavering government support and relentless cross-industry innovation, setting the stage for an electrifying evolution in China's AI landscape.

Leading the charge are China’s AI powerhouses. China boasts some of the most valuable AI companies globally, spearheading innovation and AI applications in various sectors:

- DJI ($24 billion): Known for AI-powered drones and cameras, DJI dominates over 70% of the global drone market, thanks to cutting-edge image recognition, object detection, and autonomous vehicle technology.

- Sensetime ($17 billion): Sensetime excels in AI software, with expertise spanning facial recognition, image recognition, object detection, video analysis, autonomous driving, and remote sensing.

- UBtech Robotics ($7 billion): UBtech specializes in humanoid robots tailored for education, entertainment, and healthcare. Their proficiency in motion-control algorithms and computer vision sets them apart.

- Megvii ($4 billion): Renowned for AI-driven image recognition and deep-learning software, Megvii's Face++ stands as the world's largest computer vision platform.

- Cloudwalk ($2.1 billion): A leader in facial recognition technology, Cloudwalk focuses on financial, public security, and aviation sectors, shaping the future of authentication and security.

Large Language Models and Generative AI

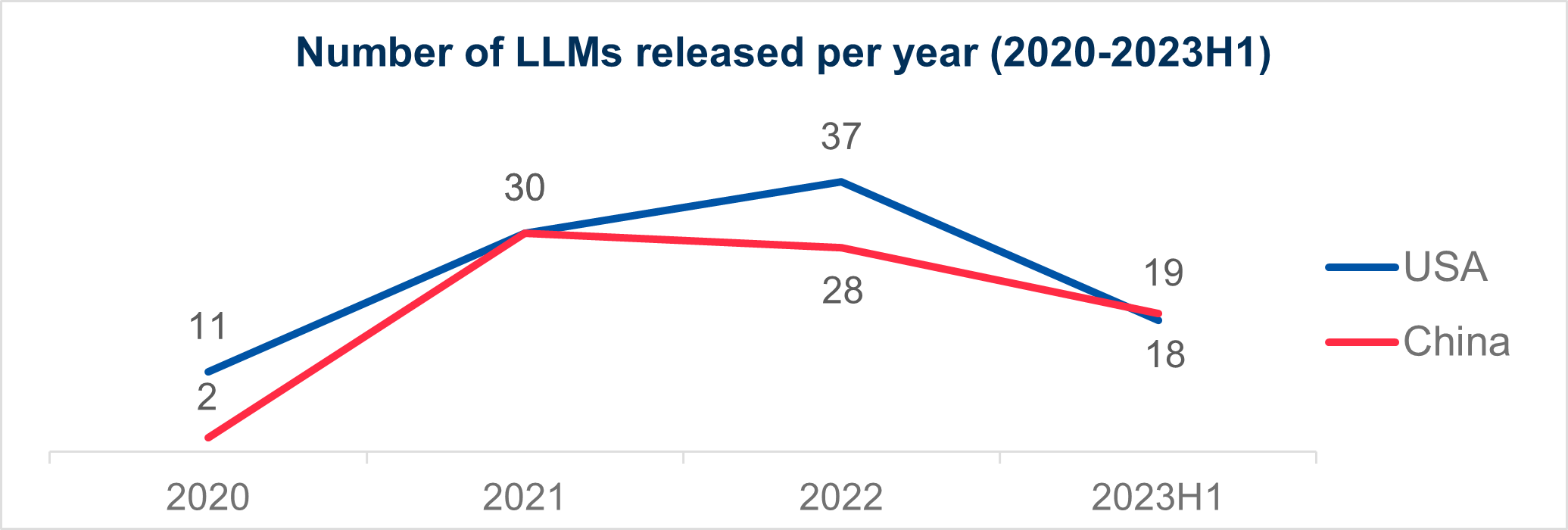

As the world watched the initial excitement around GPT wane, the competition for Large Language Models (LLMs) rages on. Companies worldwide are embracing the potential of LLMs, with China emerging as a prominent player. China kicked off a bit slowly in 2020, but by May of this year, it had already unleashed a staggering 79 LLMs with over 1 billion parameters. This prolific output positions China and the United States far ahead, accounting for over 80% of the global LLM landscape.

Source: Institute of Scientific and Technological Information of China, China's Ministry of Science and Technology

Charting the LLM Landscape in China

The latest insight into the Chinese LLM ecosystem comes from IDC's 2023 AI Large Model Technical Capability Assessment Report. The report evaluates major Chinese LLMs across 12 critical indicators across three core categories: product technology, service ecology, and industry application.

The dominant force? Baidu’s Wenxin models. In overall comprehensive ability, Baidu's Wenxin emerges as the indisputable leader. Wenxin models have secured top marks across algorithm model, general ability, innovation capability, platform strength, and ecological cooperation. With the broadest industry reach among nine leading tech companies, Baidu asserts its dominance.

Alongside Baidu’s Wenxin, Alibaba’s Tongyi Qianwen shines, especially in e-commerce related fields, and other models like iFlytek Spark, 4Paradigm’s SageGPT, Zhipu AI’s ChatGLM, and Cloudwalk’s Congrong complete the lineup of leading LLMs in China.

Applications by China’s tech conglomerates

Today, we’ll be delving further into the depths of this dynamic landscape with the titans of Chinese tech – Baidu, Alibaba, and Tencent, collectively known as BAT – as our focus, as these are the companies that are scripting the future of AI in China and beyond. They’ll be at the forefront of applying these latest models into their diverse tech ecosystems and supporting external companies to do the same. At the moment of speaking, they have all announced their own models and are working on integrating related capabilities to optimize already mature services and explore new business opportunities.

Baidu: Elevating User Experiences & Enabling Industries

Baidu's Ernie BOT, launched in March 2023, rivals GPT supporting audio, image and video capabilities, and amplifies user experiences. Apart from using the LLM capabilities to offer enhanced search engine services, they also enhance other services to customers. Baidu's Baijiahao platform empowers content creators with diverse content creation tools, while its cloud storage platform deploys analytical capabilities for superior user experiences. Relevant use cases include:

- Automatic video creation: quickly generate a manuscript based on keywords and descriptions, and then automatically convert the manuscript into a video.

- File search assistant: locate photos/videos based on any descriptive information.

Industry coverage is where Baidu truly shines. It leads by partnering with market leaders like TCL and Geely, building 11 industry-specific LLMs spanning aerospace, automotive, energy, and more. With a venture capital fund to fuel innovation, over 300 eco-partners, 400 success stories, and over 150,000 enterprise applications for Ernie bot, Baidu's LLM ecosystem is primed for exponential growth.

Alibaba: Enhancing Ecosystems

Following a similar approach, Alibaba's Tongyi Qianwen, unveiled in April, enables external business development and supports customized LLMs by offering clients access to the model and providing a dedicated API to developers.

Internally, it enriches applications across DingTalk (Digital collaboration workplace & app development platform) and Tmall Genie products (IoT-enabled smart home appliances), streamlining tasks and offering dynamic engagement opportunities. Here, remarkable use cases include:

- Automatic mini app generation for DingTalk: create a mini app by photographing a draft idea written on paper

- Dynamic AIGC-powered engagement for Tmall Genie: develop and tell stories to children, recommend background music for different scenarios, etc.

The long-term vision is full integration within Alibaba's vast ecosystem, enhancing user experiences across enterprise communication, intelligent voice assistance, e-commerce, search functions, navigation, and entertainment.

Tencent: Forging Ahead Internally

Tencent, a pioneer in content creation across games, videos, and music, unveiled its Hunyuan AI LLM in April 2022. For now, it's reserved for internal use. With a plethora of front-end application scenarios, including games, social networking, content, advertising, and enterprise services, Tencent is poised for increased AI adoption.

Key applications they focus on are already pushing the boundaries of content creation and can grant them a significant edge in their industry. Examples include:

- Automatic 3D scene creation, enabling them to generate scenes in hours instead of days.

- Real-time commentary generation, where the application understands highlights, cut scenes, generate commentary and a broadcaster’s voice, significantly enhancing game & sports commentary.

The Future of LLMs: Specialized Models

As the world watches, the LLM landscape matures, with applications expanding across various sectors. While initial use cases revolved around direct content generation, we can now see applications getting more and more sophisticated, integrating multiple types of data and content, and offering specialized use cases for specific purposes, such as automotive (infotainment & autonomous driving), coding (app generation), 3D modeling (game design), etc.

As LLM services from players like Baidu and Alibaba continue to lower the barrier to adoption, the market will become more and more mature and it’s not unlikely that specialized models will start to dominate their respective markets. Specialized models will be able to understand specific terminology and be sensitive to industry-specific contexts and intricacies. As such, they’ll boost adoption in industries requiring high levels of accuracy such as healthcare, finance and law, but also enable specific use cases like autonomous driving and manufacturing.

The LLM revolution worldwide is setting the stage for a new era of AI-driven innovation. The journey has just begun, and the possibilities are limitless. Stay tuned as we venture further into this exciting realm of technology to see how also you can reap the benefits.

Related Insights.