AGP China Technology Report - Logistics & Warehouse Robots

Table of Contents

Page Section

03 Technology Overview

06 Historical Development Timeline

09 Product Differentiation

16 China Technology Ecosystem

19 Sino-Foreign Collaboration

22 Common Applications In China

25 Government Policy Support

27 Impact On Market Incumbents

29 Final Conclusion

30 Appendices

1.1 Global Snapshot

Definition and Classification

Logistics and warehouse robots are automated systems designed to perform tasks such as material handling, sorting, packaging, and transportation within warehouse and distribution environments. These robots can be categorized into several types:

- Autonomous Mobile Robots (AMRs): Self-navigating robots that transport goods within warehouses.

- Automated Guided Vehicles (AGVs): Robots that follow predefined paths for material transport.

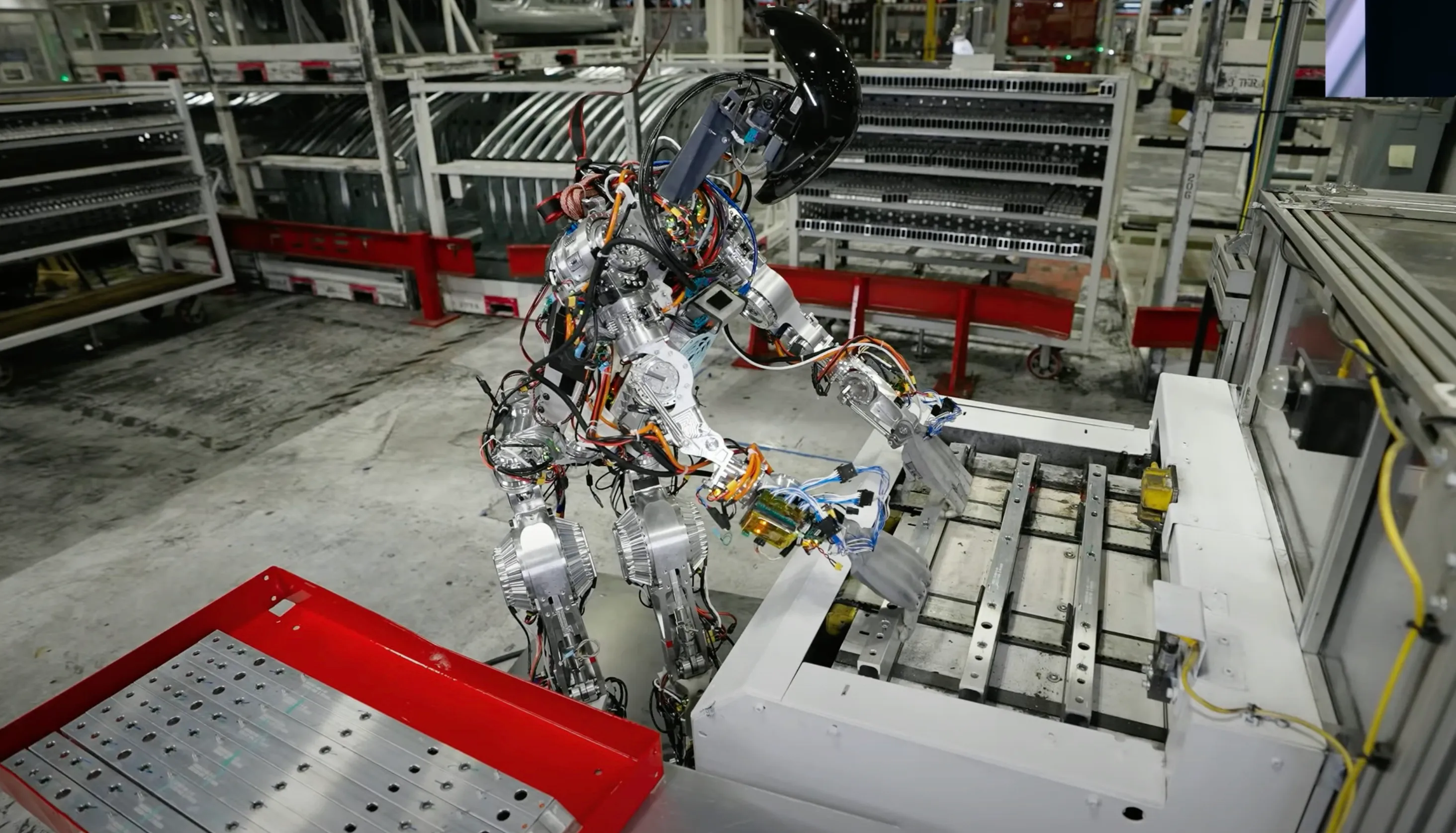

- Robotic Arms: Stationary robots used for tasks like picking, packing, and palletizing.

- Sorting Robots: Systems designed to organize products based on predefined criteria.

Key Technologies

The functionality of these robots is underpinned by several core technologies:

- Actuators: Devices responsible for movement and control, enabling precise operations.

- Sensors: Instruments that provide real-time data on the environment, facilitating navigation and object detection.

- Artificial Intelligence (AI) and Machine Learning (ML): Algorithms that allow robots to learn from data, improving decision-making and adaptability.

- Power Systems: Energy solutions that ensure sustained and efficient robot operation.

- Global Benchmarks and Market Size

Leading companies have introduced advanced robotic solutions:

- KUKA AG: In early 2023, KUKA launched AI-driven warehouse robots, enhancing picking and sorting efficiency by 68% and reducing order fulfillment time by 55%.

- Daifuku: In mid-2023, Daifuku introduced high-speed AGVs with advanced LiDAR navigation, improving warehouse transport efficiency and reducing manual handling time by 65%.

- Fanuc: In late 2023, Fanuc unveiled high-speed robotic arms designed for high-volume logistics operations, improving sorting speed by 70% and reducing warehouse processing time by 55%.

The global warehouse robotics market was valued at USD 6.1 billion in 2023 and is projected to reach USD 10.5 billion by 2028, growing at a CAGR of 11.4% during the forecast period.

1.2 China Snapshot

Market Position and Domestic Capabilities

China has emerged as a significant player in the warehouse robotics market. In 2023, the Chinese warehouse robotics market generated revenue of USD 750.4 million and is expected to reach USD 2,646.9 million by 2030, growing at a CAGR of 19.7% from 2024 to 2030.

Leading Firms and Product Deployments

Prominent Chinese companies in this sector include:

- Geekplus Technology Co., Ltd.: A leader in mobile robots and smart logistics solutions.

- Unitree Robotics: Known for developing agile and efficient robotic systems.

- Xiaomi: Diversifying into robotics with innovative warehouse solutions.

These firms have deployed robots in various applications, including e-commerce fulfillment centers and manufacturing warehouses, enhancing operational efficiency and reducing labor costs.

National Policies and Industrial Targets

The Chinese government has introduced supportive policies to bolster the robotics industry. In December 2021, the Ministry of Industry and Information Technology (MIIT) released a five-year plan for the robotics industry, aiming to advance technological innovation and expand the application of robotics across various sectors.

Cost-Performance Edge and Application Scaling

China's competitive advantage lies in its ability to produce cost-effective robotic solutions without compromising performance. This cost-performance edge facilitates the scaling of robotic applications across industries, from logistics to manufacturing.

Role in Advancing "New Productive Forces"

Warehouse robots are integral to China's strategy of developing "new productive forces" (新质生产力), which emphasize innovation-driven growth. By automating warehouse operations, these robots contribute to increased productivity and support the transition towards a more advanced industrial economy.

Link to Demographic Shifts and Industrial Upgrading

China's aging population and rising labor costs necessitate automation in industries like logistics. Warehouse robots address labor shortages and enhance efficiency, aligning with national goals of industrial upgrading and smart manufacturing.

Policy Relevance and Tech-Industry Integration

The integration of warehouse robotics into China's industrial framework underscores the synergy between policy initiatives and technological advancements. This alignment ensures that the robotics industry contributes meaningfully to national economic objectives.

1.3 Market Size

Global and China-Specific Market Estimates

The global warehouse robotics market is projected to grow from USD 6.1 billion in 2023 to USD 10.5 billion by 2028, at a CAGR of 11.4%. In China, the market is expected to expand from USD 750.4 million in 2023 to USD 2,646.9 million by 2030, with a CAGR of 19.7%.

Growth Scenarios

- High Growth: Accelerated adoption driven by technological advancements and strong policy support.

- Medium Growth: Steady adoption with moderate technological progress and policy backing.

- Low Growth: Slower adoption due to technological challenges or limited policy incentives.

5-Year CAGR Estimates

- Global Market: 11.4% (2023–2028)

- China Market: 19.7% (2024–2030)

Market Breakdown

- By Application Domain: E-commerce, automotive, food and beverage, pharmaceuticals.

- By Customer Segment: Large enterprises, small and medium-sized enterprises (SMEs).

- By Geography: North America, Europe, Asia-Pacific, Rest of the World.

These segments reflect the diverse applications and regional dynamics influencing the warehouse robotics market.

AGP Insights

Download PDF.

Your PDF report was sent successfully to your inbox!

Related Insights.