AGP Support: Market Research, Due Diligence, Innovation Scouting

Industry: Industrial Automation, Technology & Software

Edge Computing Corporate Venture Capital Investment Scouting

Client

The corporate venture capital team at a Chinese Fortune 500 IT hardware manufacturer saw an opportunity to improve the company’s industrial solutions by making strategic investments in edge computing startups.

Situation

The IT hardware manufacturer recognized growing demand for edge computing solutions to support the upgrading of China’s industrial infrastructure. However, their existing product portfolio focused on servers, gateways, and other IT infrastructure. They lacked a competitive portfolio of vertical applications that address the needs of operations teams. They saw an opportunity to grow their portfolio by investing in North American and European edge computing startups and bringing their solutions to China. This would provide competitive differentiation from other infrastructure suppliers and enable them to package their core hardware portfolio with applications delivered by technology startup partners. The approach would rapidly accelerate their time to market and provide more flexibility than internal technology development.

Approach

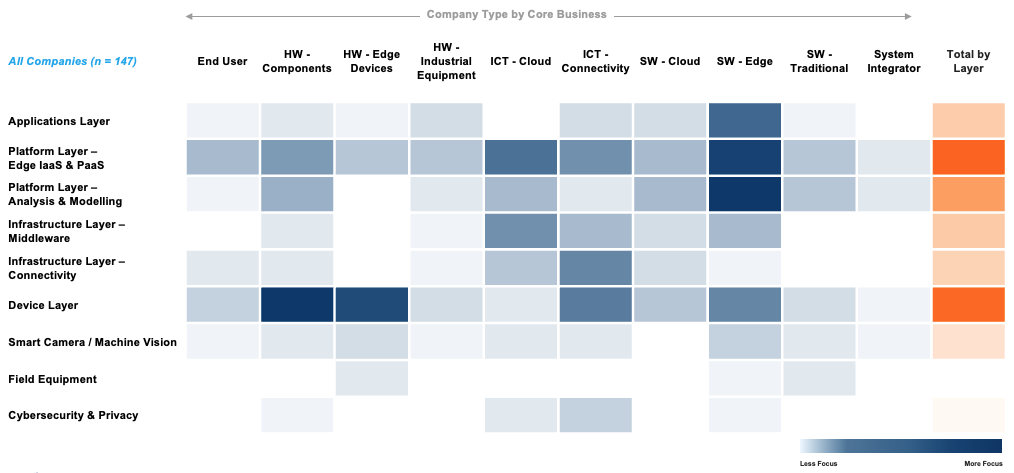

Asia Growth Partners began by mapping the North American and European edge computing vendor ecosystems in order to understand trends in technology development and use case adoption. Startups within the investment scope were then prioritized for a deeper assessment of technical capabilities, applications, business scale, and business models. We used a balanced scorecard approach to determine which companies fit best with the client’s investment plans and strategic collaboration goals. Detailed briefs of these companies were provided to the corporate venture team to initiate the due diligence process.

- Map the edge computing market, key technology domains, and application landscape.

- Build a long list of all potential investment targets in scope.

- Prioritize a shortlist of startups for initial technical and business due diligence.

- Recommend startups for the corporate venture team to initiate conversations with.